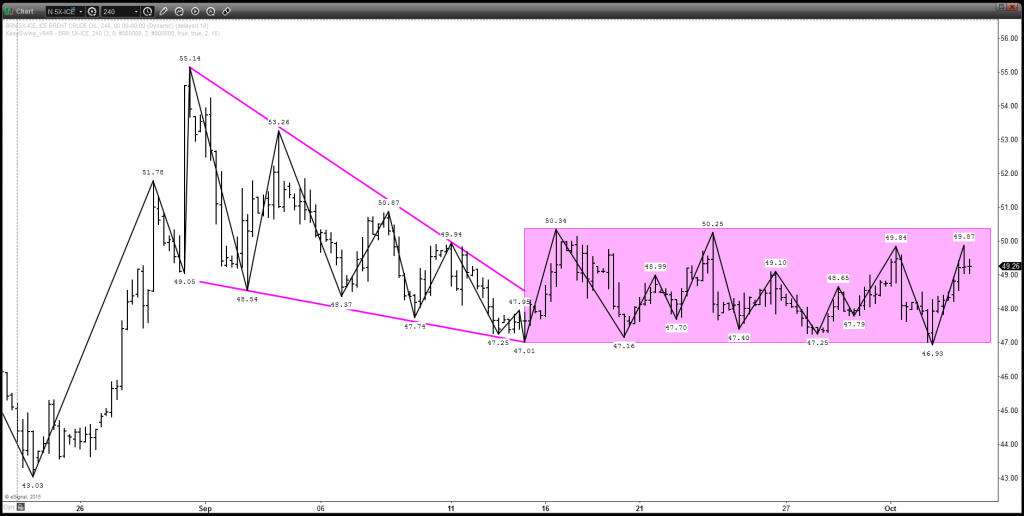

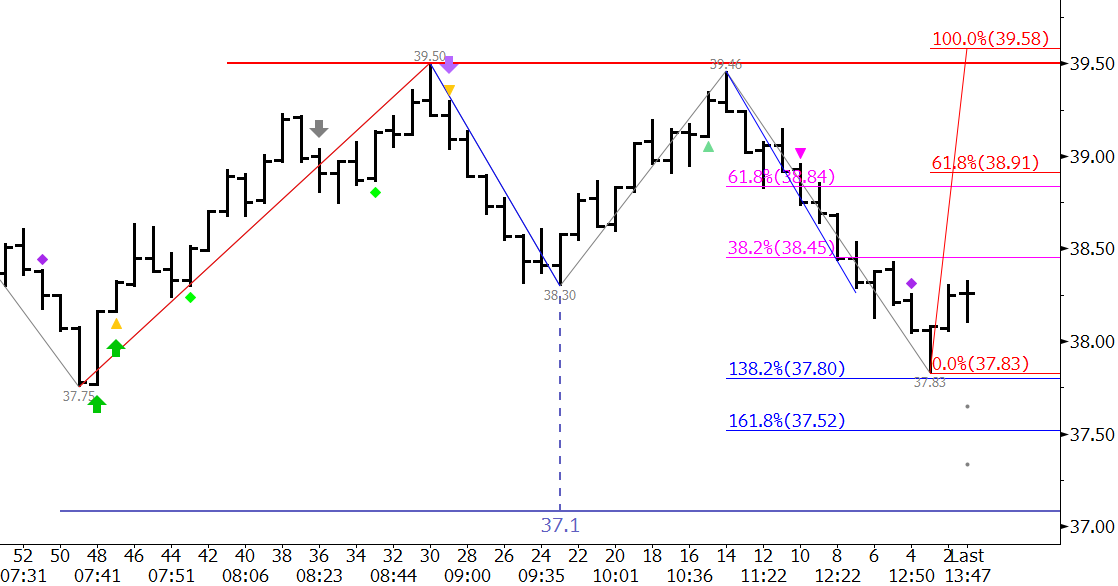

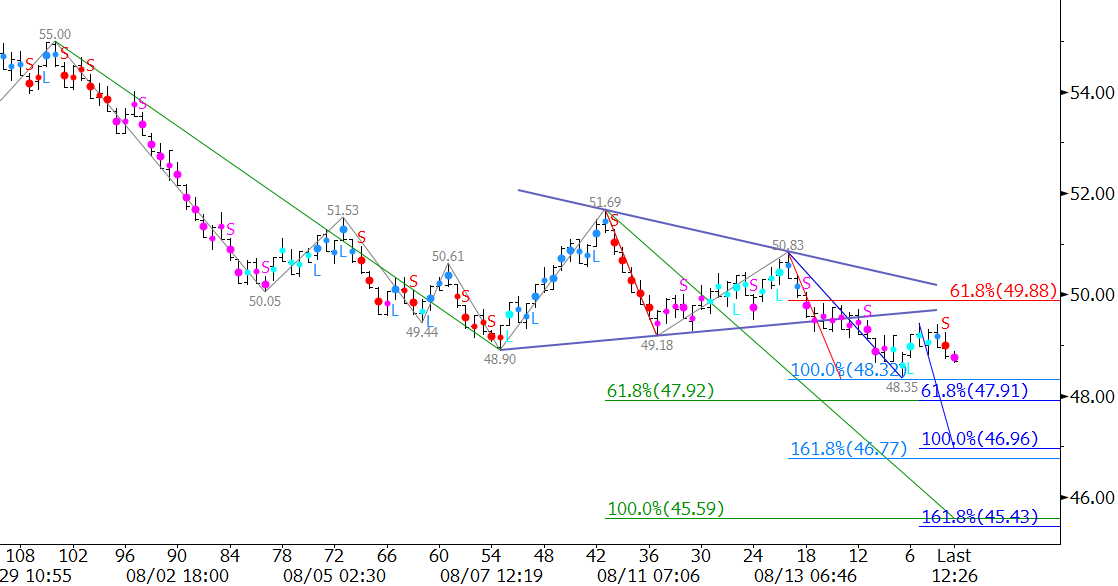

Outlook for WTI

WTI crude oil’s decline wiped out yesterday’s bullish morning star setup and fulfilled the $61.5 larger than (1.618) target of the wave $66.66 – 63.67 – 66.3. If the move down from $66.66 proves to be a three-wave correction the $61.25 swing low should hold. However, as of this afternoon, there is no definitive evidence this will be the case (though an upward correction might take place first as discussed below).

Odds favor a continued decline and a close below $61.2 will open the way for $60.8, $60.2, and $59.3. The next major objective is $58.0, the trend terminus and XC (2.764) projection of the aforementioned wave down from $66.66.

That said, there is a reasonable chance the move down from $66.66 will transmute into a five-wave formation that just completed Wave III at $61.25. If this is the case, then an upward correction to form Wave IV should take place first. Today’s $62.9 midpoint is expected to hold, but the key level is today’s $63.9 open. A close over this would be an early indication that the corrective move down may be complete.

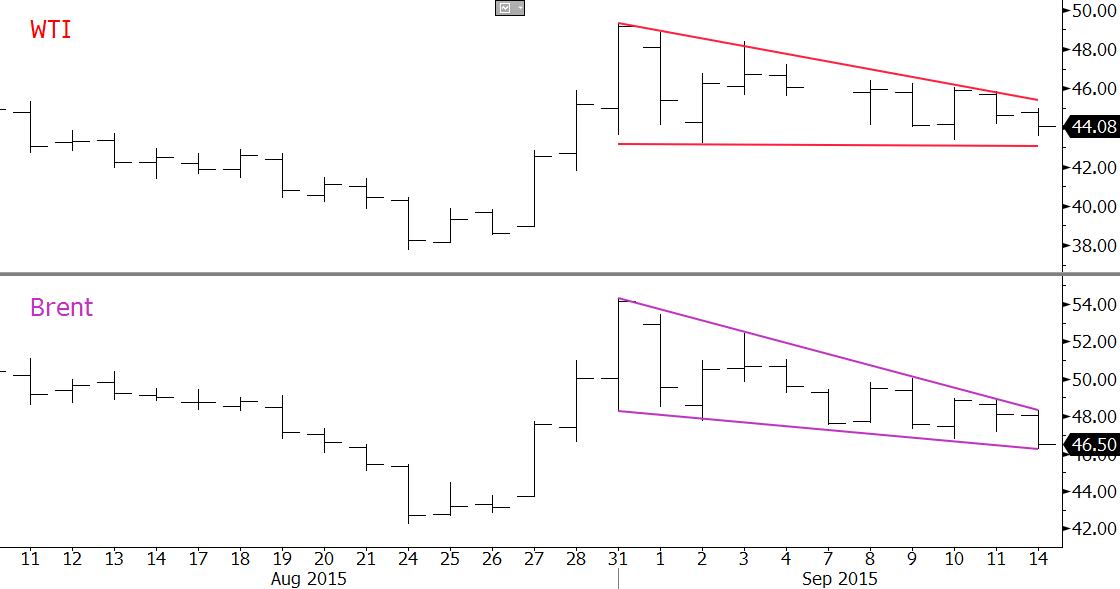

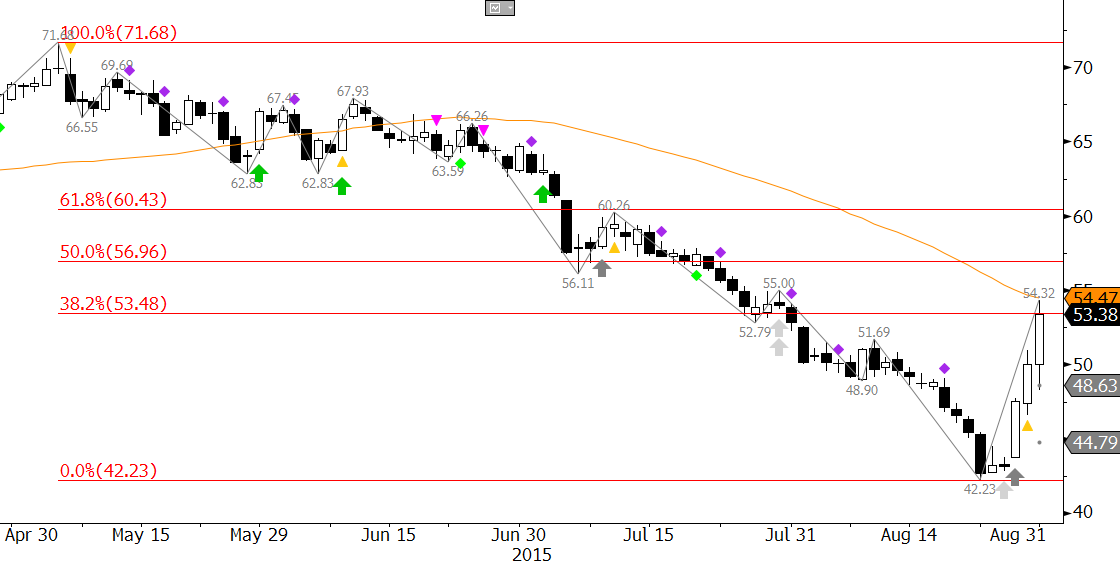

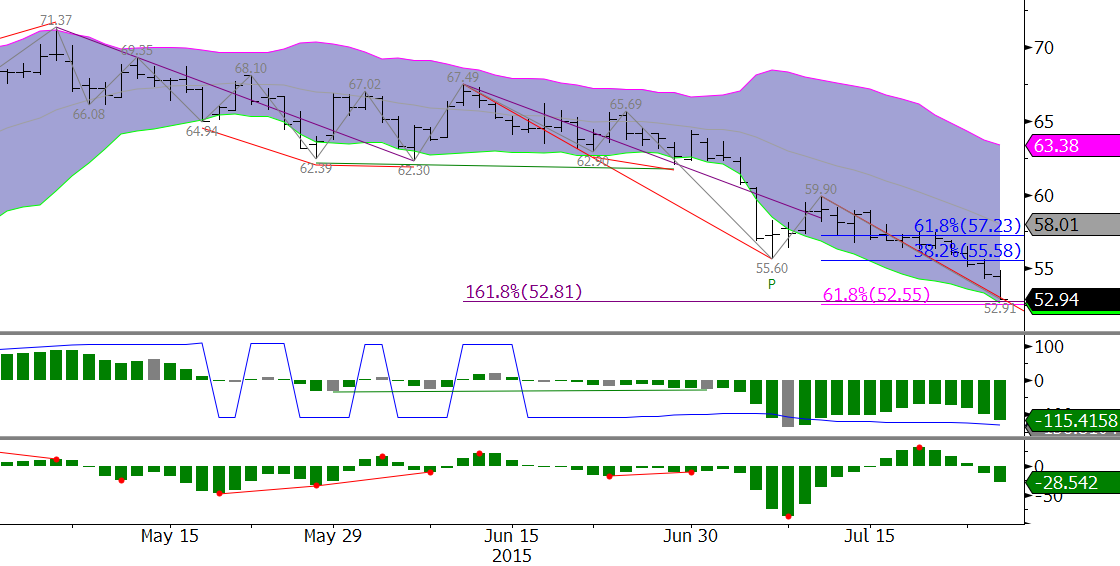

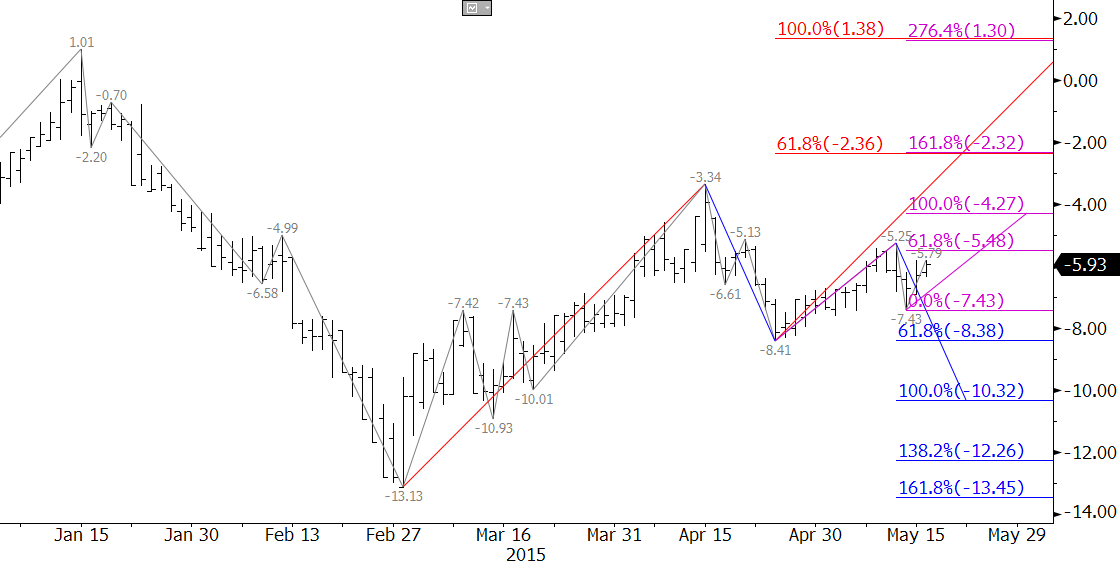

Outlook for Brent

Brent crude oil fulfilled the $65.2 larger than (1.618) target of the wave $70.78 – 67.81 – 70.02 when prices fell to $65.16 today. This is a potential stalling point, but there is no definitive technical evidence that indicates the move down will stall.

If the move down from $70.78 is a three-wave correction of the larger scale move up, then $65.16 should hold. However, this is doubtful because Brent has settled below the $65.6 smaller than (0.618) target of the sub-wave $70.02 – 66.53 – 67.72. This means that this wave should extend to at least its $64.2 equal to target. A close below $64.9 would open the way for $64.2, which then connects to $63.0 and $62.0. The $62.0 target is the next major objective because it is the trend terminus and XC (2.764) projection of the wave down from $70.78 and the larger than target of the wave down from $70.02.

With all of that said, there is a chance the wave down from $70.78 is Wave I of a five-wave pattern that completed Wave III at $65.16. In this case, an upward correction to form Wave IV should take place first. Today’s $66.4 midpoint is expected to hold upon such a correction. Key resistance is today’s $67.2 open.

This is a brief analysis for the next day or so. Our weekly Crude Oil Commentary and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.