Natural Gas Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.

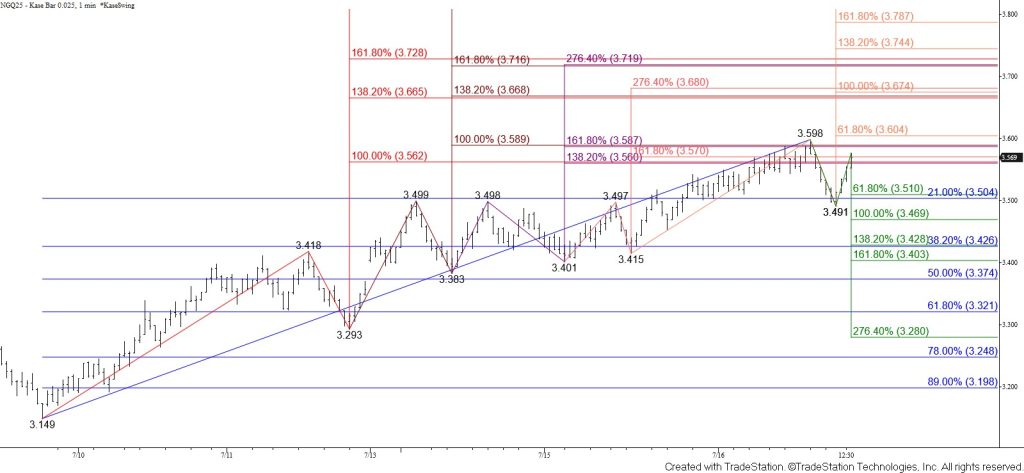

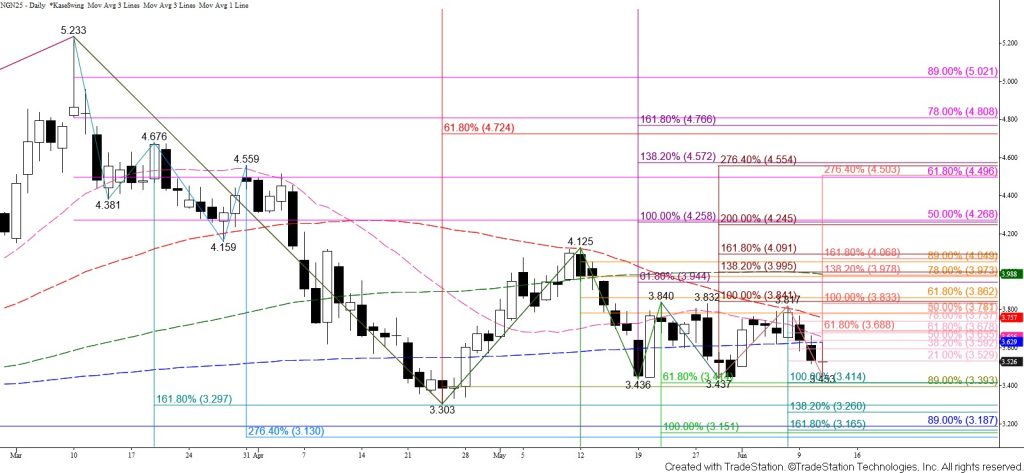

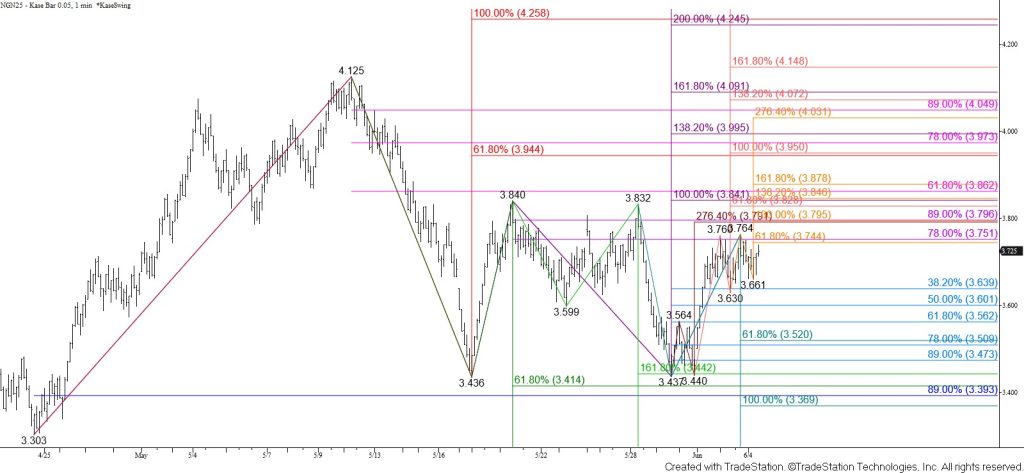

Natural gas rose to challenge a crucial objective at $3.57 today. This target is highly confluent, and, most importantly, is in line with the completion point of a weekly morning star setup, the equal to (1.00) target of the wave up from $3.149, and the 20-day moving average. Prices are rising toward $3.57 again late this afternoon. Natural gas is poised to overcome $3.57 to test at least $3.60 and likely $3.67 within the next day or so. Closing above these objectives will not only complete the weekly morning star but also open the way for a test of the reversal pattern’s $3.73 confirmation point. Settling above $3.73 will reflect rising bullish sentiment and indicate that a bullish reversal is underway.

The $3.57 target is a potential stalling point. Bearish KasePO and KaseCD divergences on the $0.025 Kase Bar chart warn that a deeper test of support might occur. However, there are no bearish signals on the daily chart, and the 21 percent retracement of the rise from $3.149 at $3.50 held. Taking out $3.50 would call for a test of key near-term support and the 38 percent retracement at $3.43. Settling below $3.43 will warn that the move up is failing and shift the near-term odds in favor of natural gas falling to challenge $3.37 and possibly the 62 percent retracement at $3.32.