Gold Technical Analysis and Near-Term Outlook

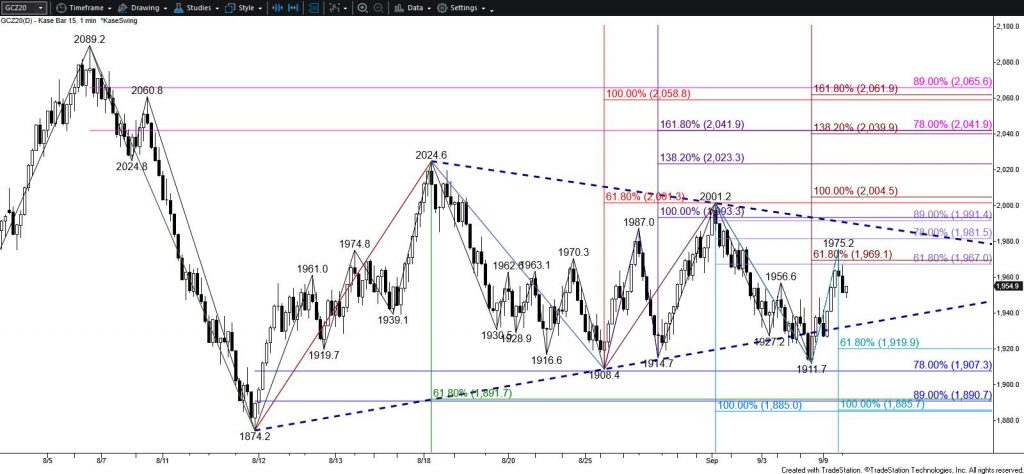

The outlook for December COMEX gold is bearish after breaking lower out of a coil pattern last week and settling below a crucial $1888 objective on Wednesday. The sustained close below $1888, the smaller than (0.618) target of the primary wave down from $2089.2, calls for gold to reach the $1810 equal to (1.00) target in the coming days.

However, there is strong near-term support around $1843. This is the most confluent wave projection and is in line with the 38 percent retracement of the move up from $1458.8. Today’s formation of a hammer also suggests that a larger test of resistance might take place before the decline continues.

The $1888 level has become initial resistance and will likely hold. However, the increase in volatility during the past few days could help drive gold to challenge $1905. These are the completion and confirmation points for today’s hammer pattern, respectively. Settling above $1905 is doubtful but would dampen odds for a continued decline during the next few days and would shift near-term odds in favor of challenging $1930 and possibly $1954.

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ration, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.