Natural Gas Near-Term Technical Analysis and Outlook

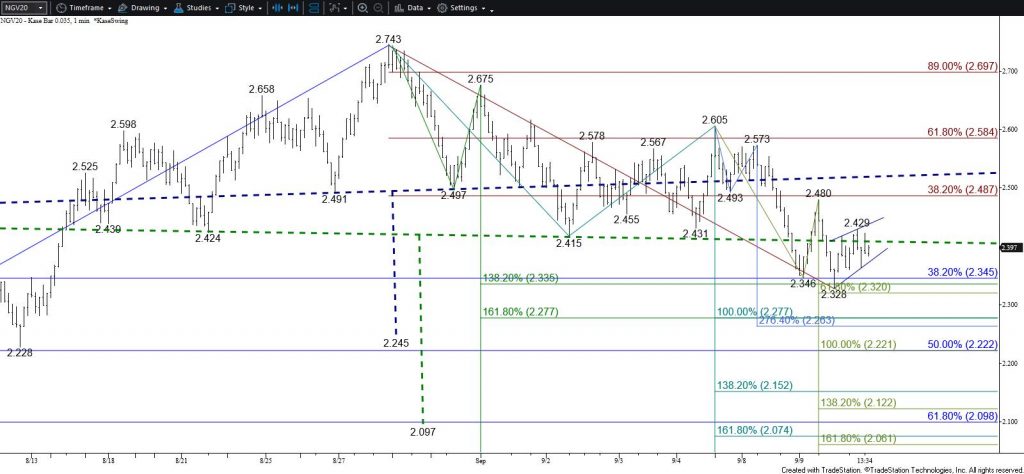

The near-term outlook for natural gas remains bearish after challenging support at $2.34 when prices fell to $2.328 today. This is a relatively important area of support because it is the intermediate (1.382) target of the first wave down from $2.743 and the 38 percent retracement of the rise from $1.700. Even so, the subsequent move up from $2.328 forms a bearish pennant that should break lower tomorrow.

Closing below $2.33 (adjusted from $2.34) will clear the way for $2.28. This is another potential stalling point because it is the larger than (1.618) target of the first wave down from $2.743 and the equal to (1.00) target of the primary wave down from $2.743. As discussed in yesterday’s update, settling below $2.28 might initially be a challenge, but odds for this are increasing.

The one caveat headed into tomorrow is that natural gas has not settled below the $2.40 neckline of the complex head and shoulders pattern. Prices settled at exactly $2.40 yesterday and $2.406 today. This is not too concerning but is something to watch during the next few days. Should natural gas rise above $2.45, look for a test of $2.50. This level is expected to hold. Key resistance and the barrier to a bullish near-term outlook is $2.60.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.