WTI Crude Oil Short-Term Price Forecast

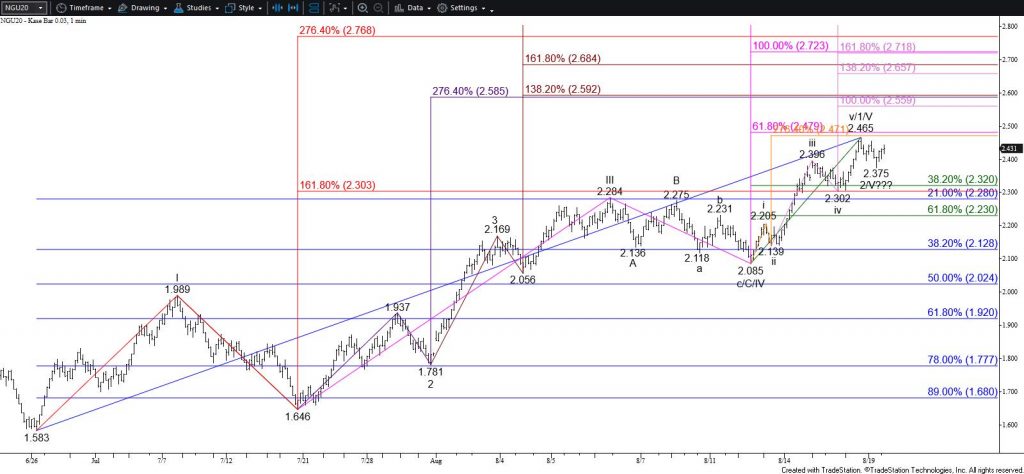

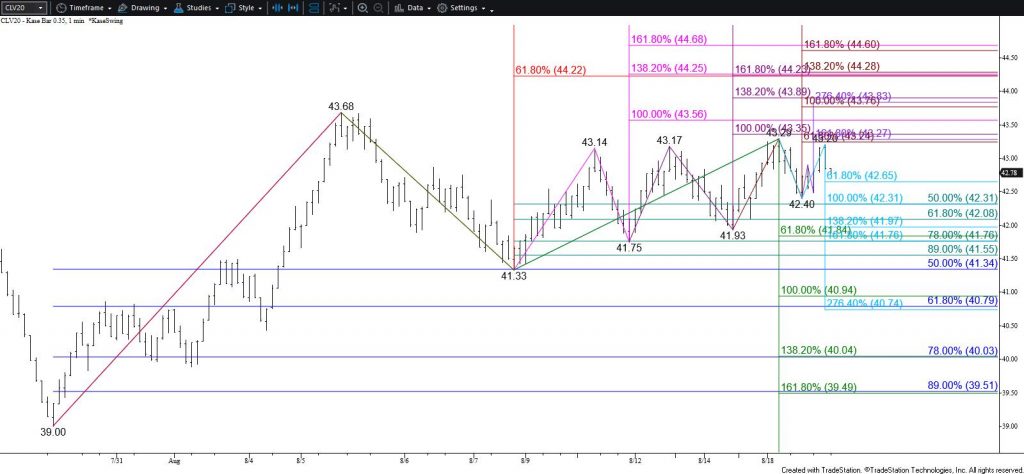

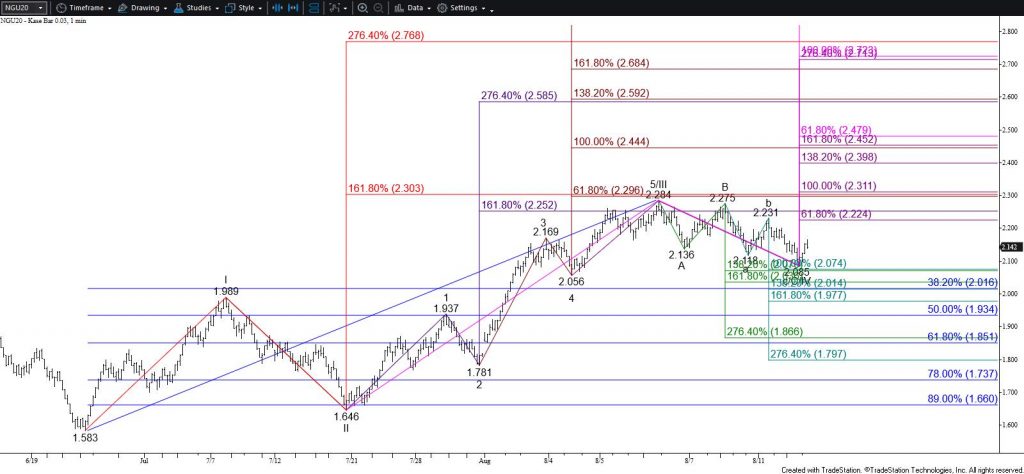

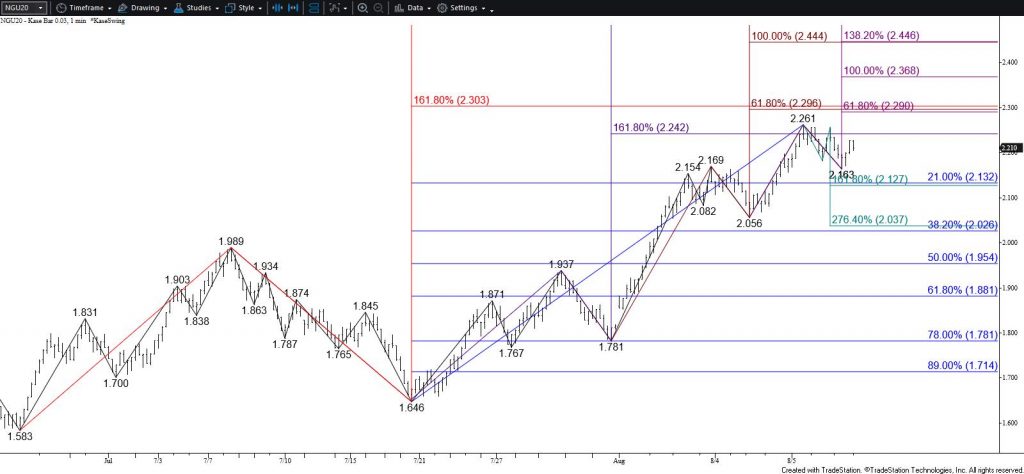

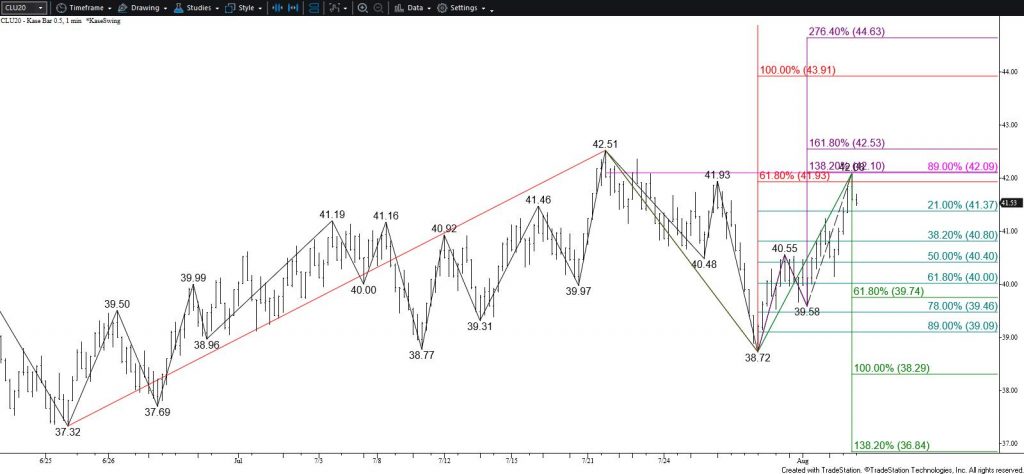

WTI crude oil rose toward the upper end of the range it has been trading in for the past several weeks. The crucial $43.4 target discussed in this week’s Commentary and yesterday’s update was challenged. This level held on a closing basis. However, WTI’s $43.35 settle was four ticks above the 200-day moving average. Therefore, the outlook leans positive headed into tomorrow.

There is immediate resistance near the $43.68 swing high, but the waves up from $39.0 and $41.33 now call for a test of $44.2. Settling above this will call for $44.6 and then $46.0.

That said, caution is warranted. The move up has been supported by the rise in product prices for the past few days, most specifically by gasoline. Gasoline had the least negative outlook coming into the week and has likely been driven higher because of supply fears caused by hurricane Laura. Even so, gasoline pulled back this afternoon and formed a long-upper shadow. This suggests its move up might be short-lived. Should gasoline continue to fall tomorrow, WTI will be hard-pressed to overcome $44.2. Therefore, gasoline, and to a smaller degree, diesel, will probably determine the direction of WTI during the next few days.

For WTI, falling below $42.7 will imply that a test of $42.2 support is underway. The $42.2 level is near the 62 percent retracement of the rise from $41.33, the smaller than (0.618) target of the wave down from $43.68, and the 20-day moving average. Closing below this would call for key support at $41.2. This is the equal to (1.00) target and 50-day moving average. Settling below $41.2 would clear the way for a much larger test of support before the move up continues.

Brent Crude Oil Short-Term Price Forecast

Brent rose to the top of its trading range and settled above the $45.6 level discussed in yesterday’s update. The move up is now in a position to break higher out of the range and reach $46.4. This is the smaller than (0.618) target of the primary wave up from $41.72 and is marginally below the 200-day moving average. Settling above $46.4 will clear the way for $46.9 and higher.

Nevertheless, as discussed for WTI, the degree to which Brent rises during the next few days (and possibly longer) will largely be determined by gasoline and diesel prices. Should they continue to fall, Brent’s move up will be short-lived.

For now, initial support at $45.1 will likely hold. Falling below this will call for $44.4, which then connects to key support at $43.5. Settling below $43.5 will clear the way for a much more significant downward correction before Brent’s move up continues.

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.