Natural Gas Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.

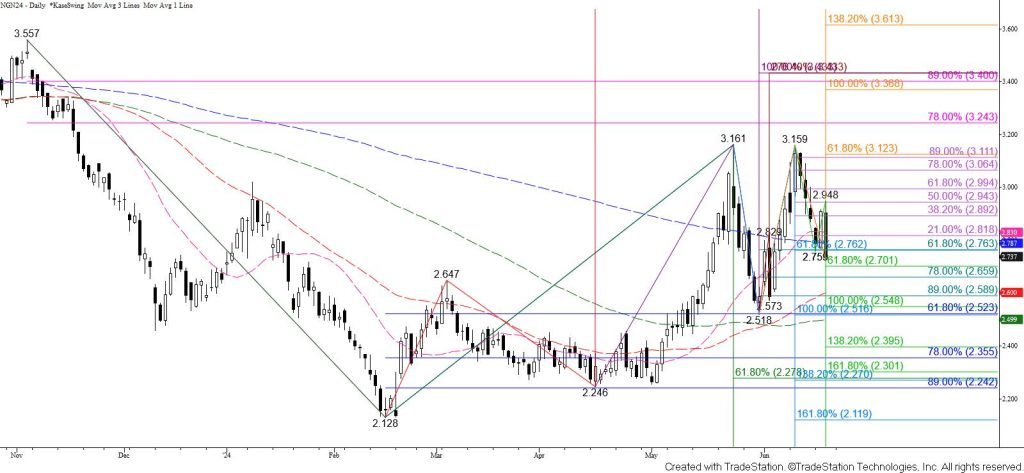

Natural gas has continued to decline toward the psychologically important $2.00 level as called for. Today’s decline reflects a resurgence in bearish sentiment. The $2.03 larger than (1.618) target of the wave down from $2.448 held, but the larger and more important waves down from $3.590 and $3.221 call for a continued decline.

Tomorrow, look for a test of the $2.00 target of a confirmed $3.21 double top and likely the $1.97 XC (2.764) projection of the first wave down from $3.221. This is also the smaller than target of the wave down from $3.027. The $1.97 objective is a potential stalling point. However, any move will likely be a correction because the wave down from $3.590 favors an eventual test of its $1.84 equal to (1.00) target.

The daily Stochastic has been oversold for a few weeks and the RSI entered oversold territory today. A test of resistance will probably take place soon, but no bullish patterns or confirmed signals call for such a move. Even so, should prices rise before taking out $2.00 look for initial resistance at today’s $2.11 midpoint. Overcoming this would call for a test of key near-term resistance at today’s $2.18 open.