WTI Crude Oil Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

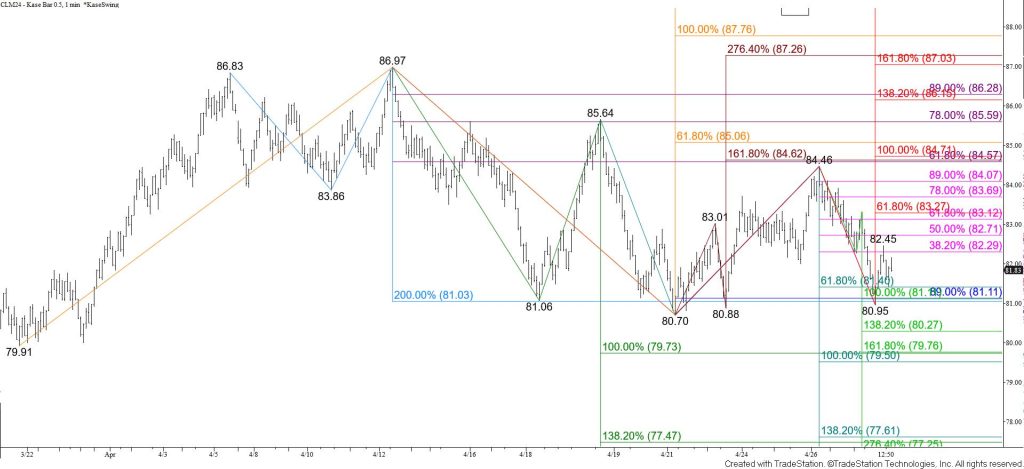

WTI crude oil fell to challenge resilient support at the $81.0 target of a confirmed double top that formed around $86.9. The $81.0 target held again, and prices formed a wave up from $80.95 that warns a test of $82.8 might take place first. Even so, the move up will likely be a correction because the waves down from $86.97 and $85.64 have fulfilled their smaller than (0.618) targets. Waves that meet the smaller than target typically extend to at least the equal to (1.00) target, in this case, $79.7 for both waves. Closing below $81.0 will open the way for tests of $80.3 and the $79.7 objective within the next few days.

With that said, WTI crude oil’s pullback from $86.97 may form a bullish flat descending triangle. This is a continuation pattern, a break higher out of which would be confirmed by a close above key near-term resistance at $84.6. Should WTI crude oil overcome $82.8 look for a test of $83.3 and possibly $84.6. Settling above $84.6 would strongly suggest that the corrective pullback from $86.97 is complete and shift the odds in favor of WTI crude oil rising to $$85.1 and higher.