Natural Gas Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.

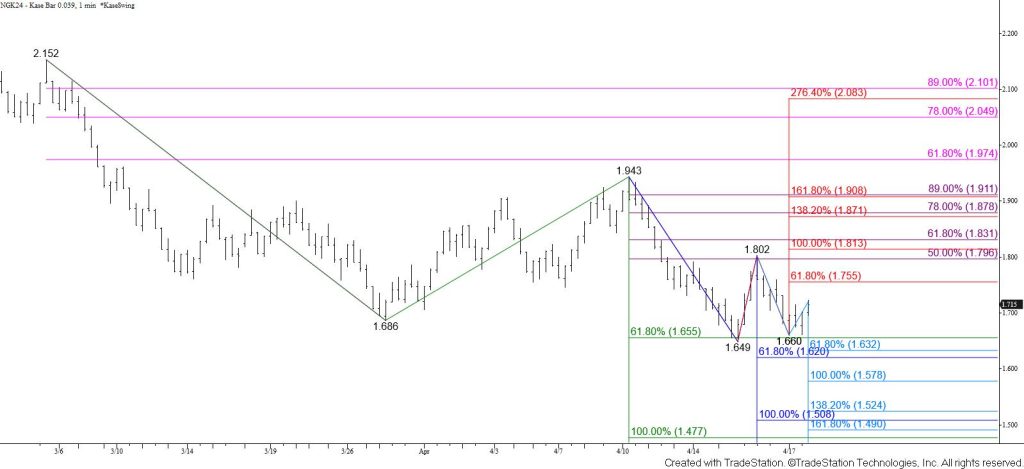

Natural gas tested the $1.66 smaller than (0.618) target of the wave down from $2.152 again today. This target continues to hold on a closing basis, and there is now a small double bottom that has formed around this key objective. Even so, meeting the $1.66 objective is bearish for the outlook because most waves that fulfill their smaller than target eventually extend to the equal to (1.00) target, in this case, $1.48. Therefore, the outlook continues to lean bearish for the coming days. Closing below $1.66 will call for a highly confluent and important target at $1.62 that then connects to $1.58 and lower.

Nevertheless, this is still an area in which the move down may stall. Should prices rise above $1.74 look for a test of the $1.76 smaller than target of the wave up from $1.649. Settling above $1.76 would call for a test of $1.82, a close above which will confirm the double bottom and put the odds in favor of a more substantial test of resistance instead.