WTI Crude Oil Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

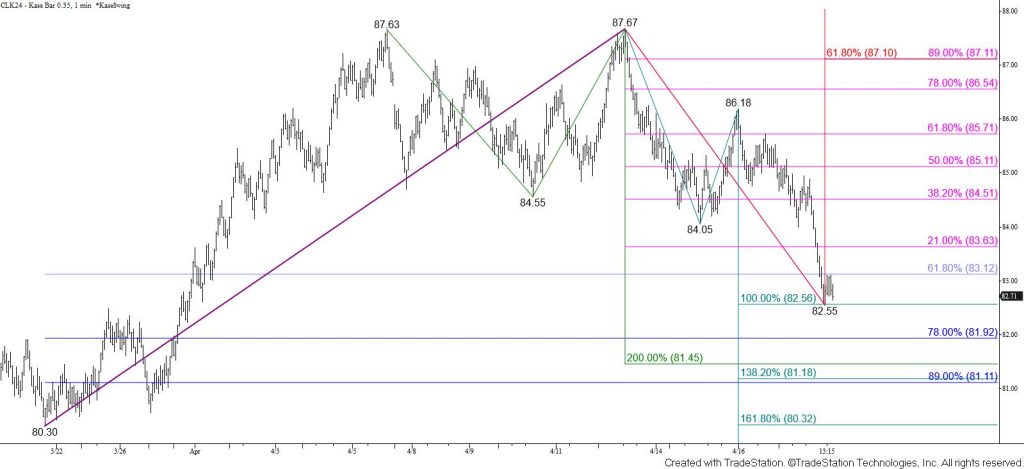

WTI crude oil’s corrective move down accelerated today. Prices settled below the 20-day moving average, the 62 percent retracement of the rise from $80.3, and the $84.55 confirmation point of a double top that formed around $87.65. The daily Kase Trend indicator is now bearish and the 10-day DMI had a bearish crossover. The $82.56 equal to (1.00) target of the wave down from $87.67 held, so a test of resistance might occur first. Even so, today’s $84.0 midpoint is expected to hold because the move down should now fulfill the $81.5 target of the double top within the next few days. Settling below $81.5 will call for the $81.1 intermediate (1.382) target and possibly the $80.3 larger than (1.618) target of the wave down from $87.67 to be fulfilled.

The aggressive nature of today’s move down likely reflects a bearish shift in near-term sentiment. Nevertheless, the move down is still a correction and would have to take out the last major swing low of $80.3 to suggest further that a reversal is underway. Also, because $82.6 held on a closing basis there is a modest chance for a test of resistance first. As stated, today’s $84.0 midpoint is expected to hold. Overcoming this would call for a test of key near-term resistance and the 38 percent retracement of the decline from $87.67 at $84.5. This was major support that has now become resistance given $84.5 is also in line with the $84.55 confirmation point of the confirmed double top.