Kase’s senior analyst Dean Rogers reviews trade setups and price forecasts for e-mini S&P 500 and WTI Crude Oil.

http://youtu.be/6ADWjwZK_kE

Tag: forecast

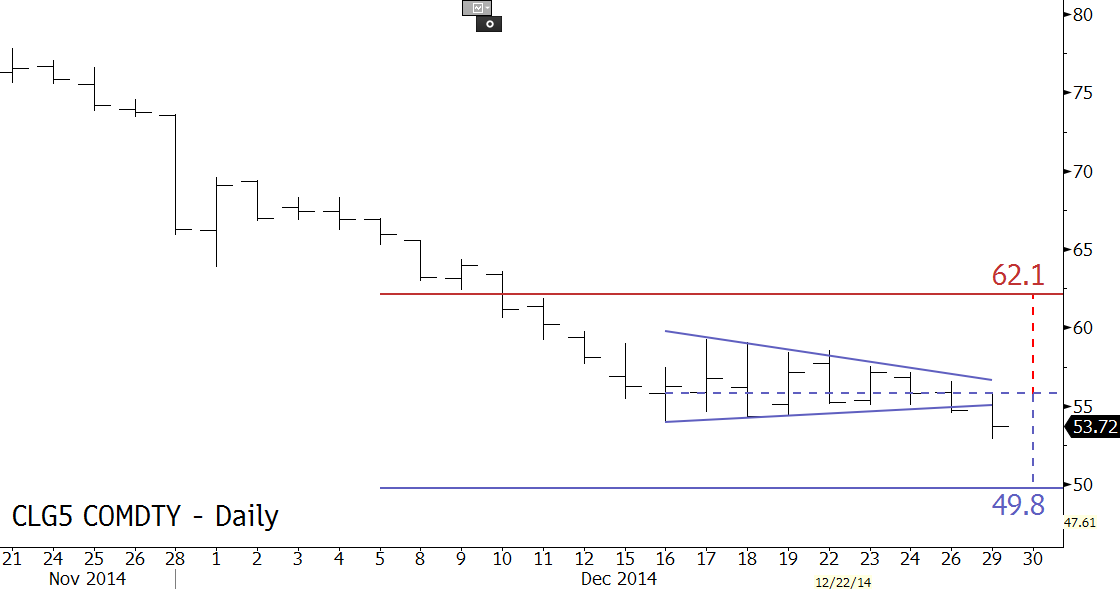

February 2015 WTI crude oil broke lower out of a coil formation on Friday and continued its decline on Monday, December 29. The target for the coil is $49.8, and is in line with a highly confluent $49.7 objective that we have discussed as a potential stalling point for several weeks. A close below $49.7 would open the way for $46.9 and $45.5. Initial resistance is $56.0, the apex of the coil. Key resistance is $61.8, which is near the coil’s $62.1 upper target.

Take a trial of Kase’s weekly energy forecasts to get more in depth analysis, targets, and probabilities.

Kase’s senior analyst Dean Rogers reviews trade setups and price forecasts for e-mini S&P 500 and Natural Gas.

To take a trial of our weekly natural gas forecast please visit the energy price forecasts page.

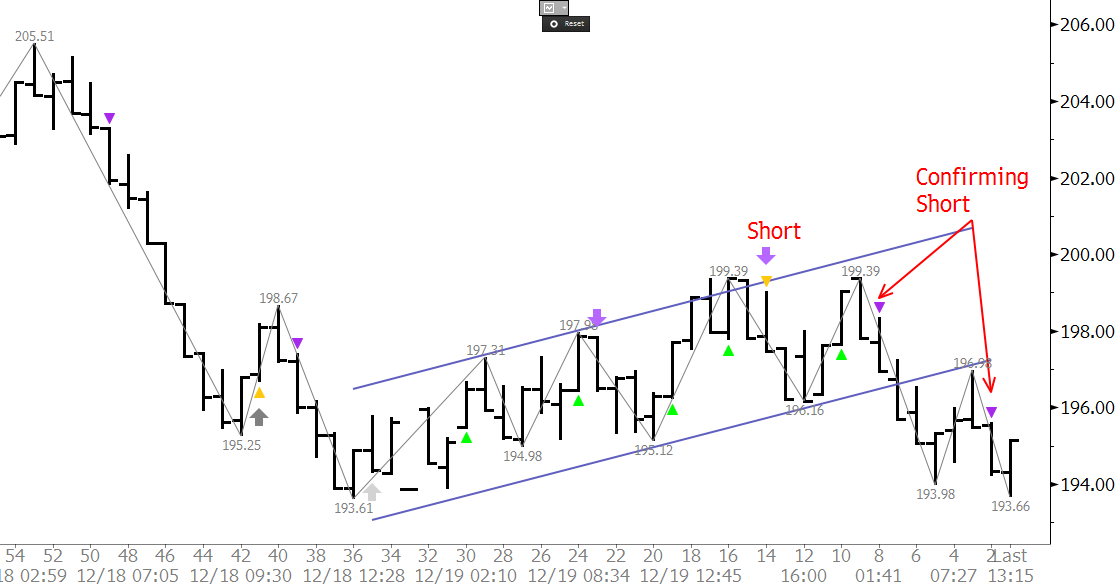

The NY Harbor ULSD futures broke lower out of a bearish flag formation on Monday. The break lower was anticipated and then confirmed by KaseX short signals. The decline is now poised to extend to at least 188.9 and then 177.9. The latter is crucial because a close below this would call for 164.1 and 151.9. Initial resistance is the small intraday double top at 199.39. A close over this would open the way for an extended correction to 210.9 and possibly 226.0.

For more information about KaseX please click here.

For more information about Kase’s weekly energy forecasts please click here.

Kase’s senior analyst Dean Rogers reviews trade setups and price forecasts for e-mini S&P 500 and WTI Crude Oil.

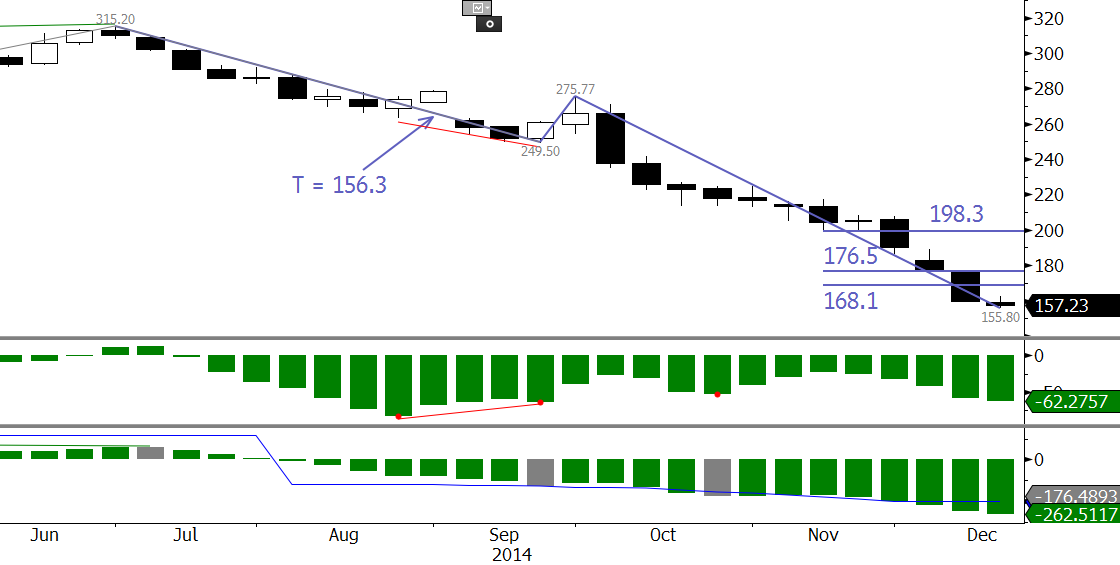

RBOB Gasoline continued its decline and met a crucial target at 155.8 for the primary wave down from 315.2. The trend terminus (T = 156.3), is the lowest that most trends extend. However, there is no evidence that the decline is going to end. The next targets are 147.3 and 139.2. The KaseCD is setup for divergence and the KasePO is oversold, so a correction may take place soon. Last week’s midpoint and open are initial resistance at 168.1 and 176.5. A close over 176.5 would call for $198.3.

Kase’s senior analyst Dean Rogers reviews trade setups and price forecasts for e-mini S&P 500, AAPL, and MSFT, using Kase Wave Analysis and Kase StatWare.

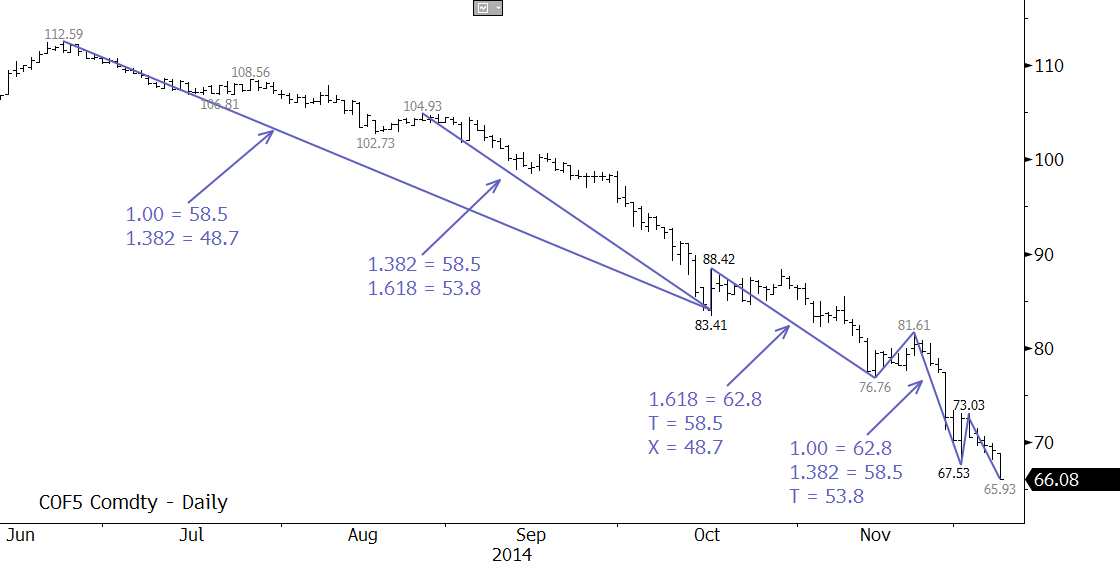

Coming into this week there was an outside chance that Brent would hold $67.0. However, prices settled below $67.0 on Monday. There is immediate support at $65.2 as discussed in this week’s Crude Oil Commentary, but the decline is now poised for at least $62.8 and likely $58.5 before a measurable retracement takes place. The key target is $58.5 because it is the most confluent wave projection and the equal to (1.00) target for the wave $112.59 – 83.41 – 88.42. A sustained close below this will open the way for $53.8 and $48.7.

There is very little evidence that the move down is going to end at this time. Prices are still deeply oversold and overdue for a correction, but until at least initial resistance at $70.5 is overcome, the move down is favored. Next resistance is $72.1, and a close over the this would call for and an extended correction to $75.1 and possibly $79.8.

For detailed weekly forecasts take a trial of our energy commentaries.

Kase’s senior analyst Dean Rogers reviews trade setups and price forecasts for e-mini S&P 500 and AAPL, using Kase Wave Analysis and Kase StatWare.

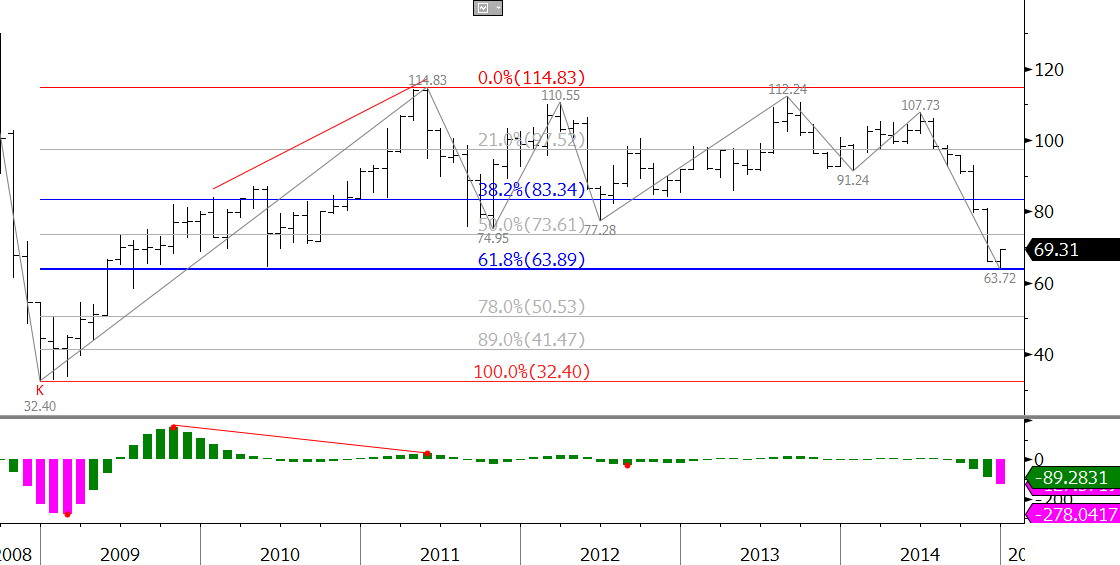

The outlook for WTI Crude Oil is negative, but prices met crucial support at $63.4. This is a confluent wave projection for the January contract, and more importantly, is the 62 percent retracement from the perpetual low of $32.4 to $114.83. In addition, the KaseCD is oversold on the monthly chart. The importance of $63.4 indicates it is a potential stalling point, but there is little technical evidence so far to definitively call for a bottom. A sustained close below $63.4 will call for $49.7. Key near term resistance is $73.3.

For more detailed energy forecasts please take a trial of the Energy Price Forecasts.