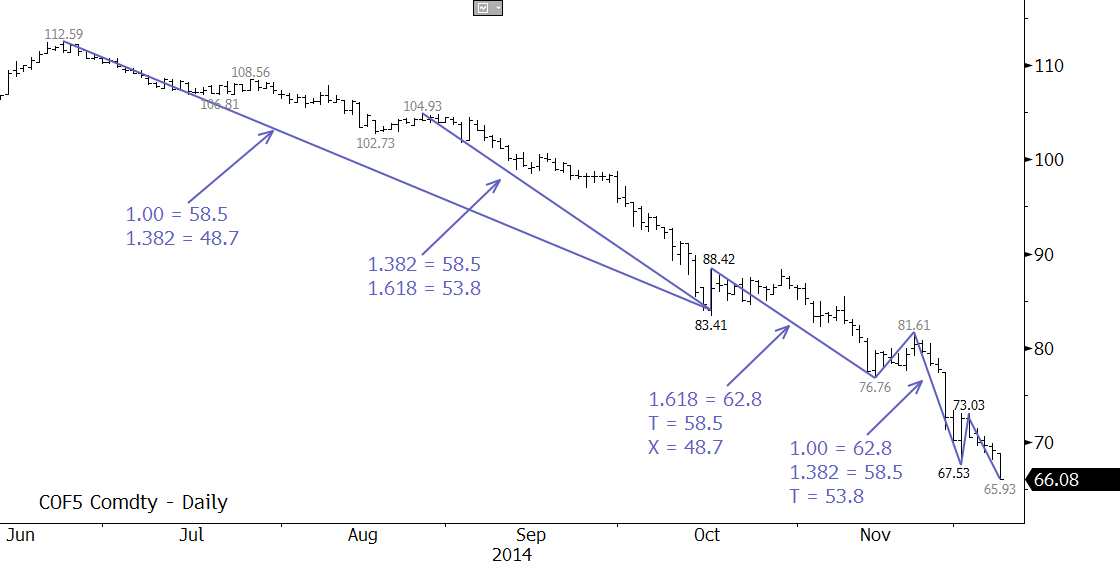

Coming into this week there was an outside chance that Brent would hold $67.0. However, prices settled below $67.0 on Monday. There is immediate support at $65.2 as discussed in this week’s Crude Oil Commentary, but the decline is now poised for at least $62.8 and likely $58.5 before a measurable retracement takes place. The key target is $58.5 because it is the most confluent wave projection and the equal to (1.00) target for the wave $112.59 – 83.41 – 88.42. A sustained close below this will open the way for $53.8 and $48.7.

There is very little evidence that the move down is going to end at this time. Prices are still deeply oversold and overdue for a correction, but until at least initial resistance at $70.5 is overcome, the move down is favored. Next resistance is $72.1, and a close over the this would call for and an extended correction to $75.1 and possibly $79.8.

For detailed weekly forecasts take a trial of our energy commentaries.