Kase’s senior analyst Dean Rogers reviews trade setups for $TSLA, $HTZ, $TLLP, and $GM using Fibonacci wave projections, retracements, geometric patterns, and Kase StatWare.

http://youtu.be/TAh2xUGXXtw

Author: Dean Rogers, CMT

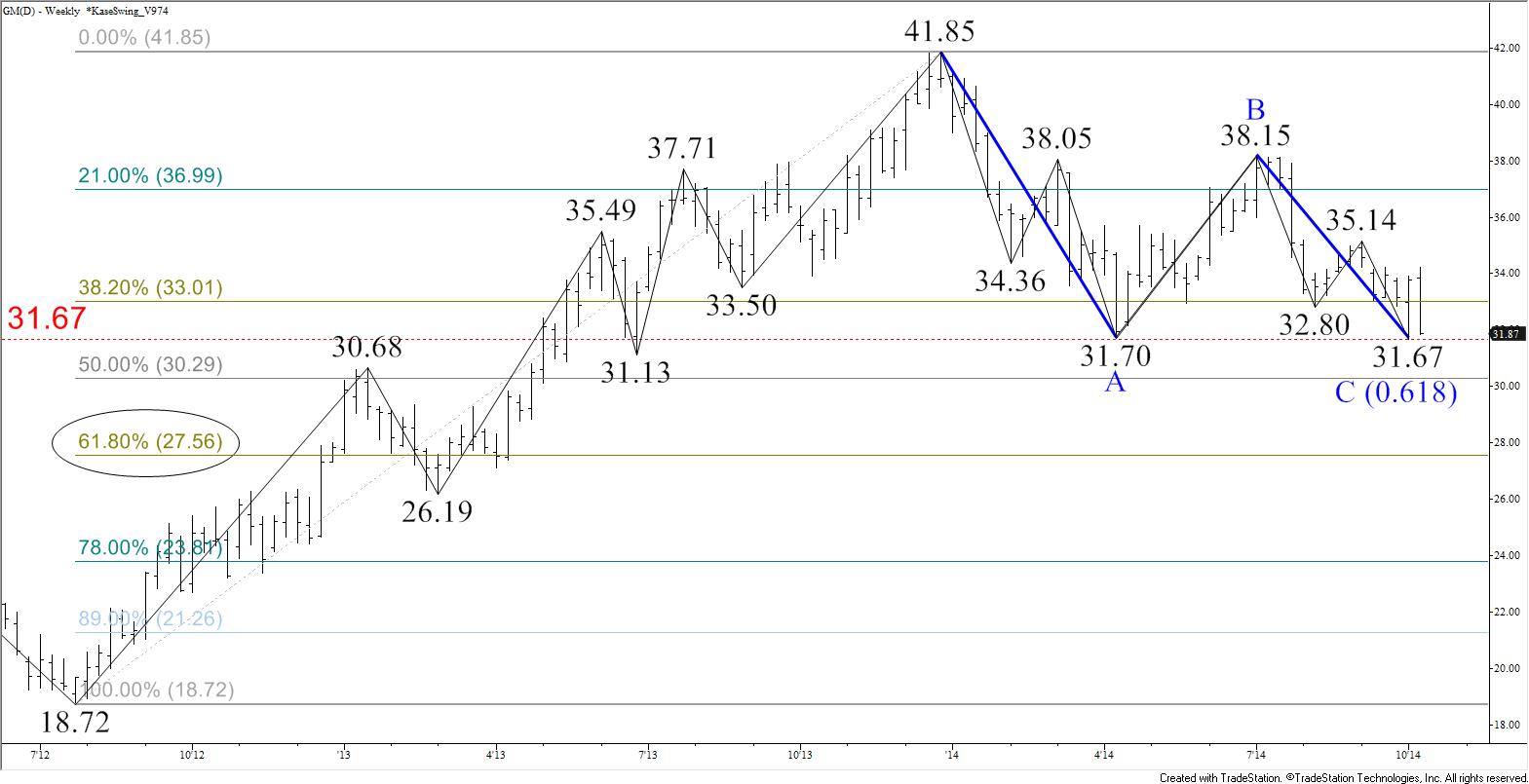

GM’s decline from $41.85 may be corrective longer term, but the recent $31.67 swing low fulfilled the 0.618 projection for Wave A, $41.85 – 31.7 – 38.15. This indicates the decline should continue because most waves that meet the 0.618 projection extend to at least the 1.00 projection, in this case, $28.0. This is near the 62 percent retracement of the move up from $18.72 to $41.85 at $27.56. These two factors, along with other sub-wave projections for the decline from $38.15, form a confluence point at $27.8. This is key target for the near-term and will likely be tested within the next few weeks. It is also a decision point for the longer-term. The confluence at $27.8 indicates it is a potential stalling point, but a weekly close below $27.8 would open the way for longer-term bearish objectives of $26.7, $24.0, and $21.8.

That said, a small double bottom may have formed at $31.67. This is a crucial area that has held so far, but October 7’s gap lower indicates $31.67 will not likely hold for much longer. Look for resistance at $34.2. The key level is $35.3. This is the 38 percent retracement from $41.85 to $31.67, and is in line with the 35.14 swing high. A close over this would call for an extended correction and attempt to confirm the double bottom with a close over $38.15. Confirming the double top would shift the long-term outlook to bullish and call for $44.6 and higher.

That said, a small double bottom may have formed at $31.67. This is a crucial area that has held so far, but October 7’s gap lower indicates $31.67 will not likely hold for much longer. Look for resistance at $34.2. The key level is $35.3. This is the 38 percent retracement from $41.85 to $31.67, and is in line with the 35.14 swing high. A close over this would call for an extended correction and attempt to confirm the double bottom with a close over $38.15. Confirming the double top would shift the long-term outlook to bullish and call for $44.6 and higher.

Kase’s senior analyst, Dean Rogers, reviews various techniques for trading with the Kase StatWare, KaseX, and Kase Private Label signals.

http://youtu.be/lz8cf6It-kQ

Simple yet sophisticated, KaseX is a trading “mega-study” with a simple, uncluttered display. KaseX captures a tremendous amount of technical and statistical analysis in multiple time frames, by condensing the acclaimed Kase StatWare® studies into three, simple, color-coded symbols that identify possible entries, exits and stops. No adjustments of variables are necessary as pre-configured sensitivity settings are built in.

Whether you are looking for cutting edge studies or a clearer approach to making trading decisions, Kase has you covered! Our latest mega-study, KaseX condenses in-depth market analysis in a simple, straightforward display.

This proprietary, state-of-the-art, market-timing indicators condenses its signals into a simplified, color coded display system to fine tune entries and exits. StatWare™ is valued by traders because it combines high accuracy with ease of use. Works with all liquid and active stocks, commodities, futures, indices and FOREX.

The Kase Commentaries on Crude Oil and on Natural Gas provide highly accurate weekly near term market outlooks. Kase’s analysis has proven to be remarkably accurate in identifying critical market turning points and probable market behavior.nnThe Commentary is highly technical, but interactive, so readers can click on unique words and phrases for definition to help them better understand the analysis. This is a great stand-alone product, but also works well as a companion product for Kase StatWare, KaseX or any of Kase’s Hedging Models.nnKase offers a free trial period for the Commentary so contact us today!

Successful long term hedging requires logical decision-making. Hedgers need to understand the underlying structure of the market and longer-term behavior in order to find points that minimize the risk and maximize the results of a hedge plan. It is also important to find the best balance for your company between budget oriented goals and achieving better than market prices. The HedgeModel identifies these low risk points and can be custom tailored to whatever strategy is befitting your mixture of goals and risk tolerance.

The HedgeModel is statistically based and does not require any previous trading experience to use. It is more-or-less mechanical and requires only 15 to 20 minutes per day to operate. It is data driven, so it works on any historic data stream in energy, including natural gas, crude oil, refined products, petrochemicals and crack spreads.

The Natural Gas Hedge Report is a companion product to Kase’s HedgeModel that includes a forecast for the perpetual, three-, six- and twelve-month strips. It also includes recommendations on how to set hedging strategies for the forthcoming quarter, changes to the settings used by HedgeModel, low-risk hedge targets, recommendations on what instruments to use, a track record and mark to market of recommended strategies, and research results.

Kase also performs ongoing research into market behavior and structure. Our research is oriented toward improving the results of our clients’ hedging strategies. In addition to a thorough evaluation of basis and correlation analysis, standard research in our quarterly Hedge Reports includes Monte Carlo simulations for estimating price distributions and objectives, statistical analysis of price and volatility, and cyclical behavior.