Natural Gas Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.

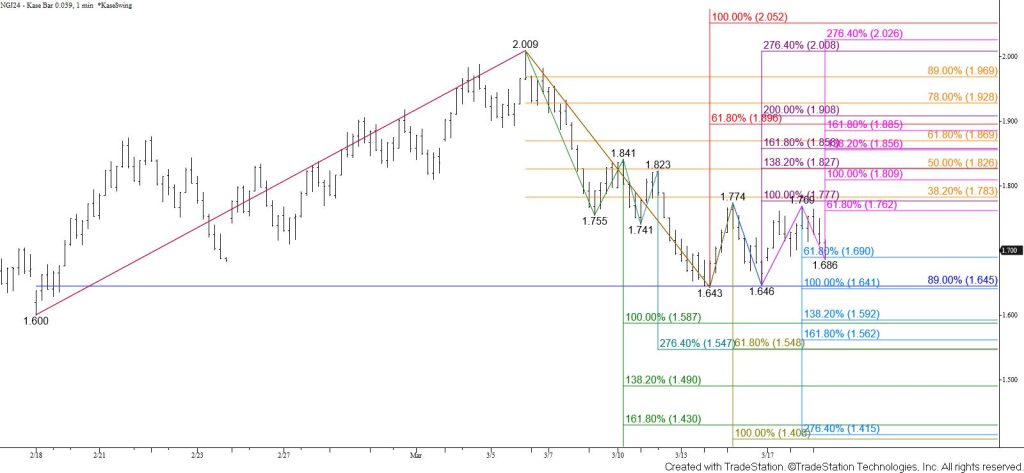

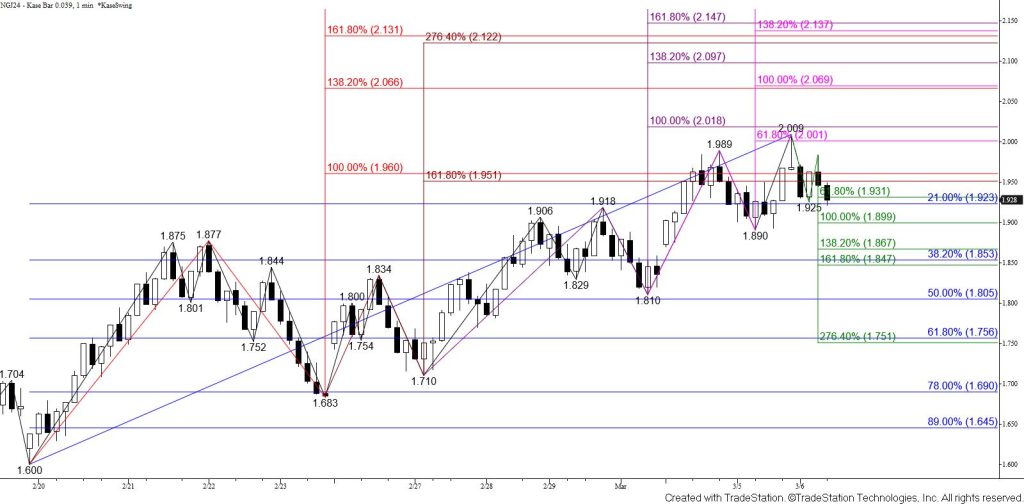

Natural gas is stuck in a trading range between $1.64 and $1.77. Prices failed to test the top of the range and the $1.78 equal to (1.00) target of the wave up from $1.643 after settling above this wave’s $1.73 smaller than (0.618) target Tuesday. Instead, April natural gas fell to test the $1.69 smaller than target of the wave down from $1.774. This is also the 62 percent retracement of the rise from $1.646. The $1.69 target held on a closing basis, but meeting this objective has put near-term odds in favor of testing the $1.64 equal to target of the wave down from $1.774. Taking out $1.67 will increase the odds for such a move. Closing below $1.64 will confirm a bearish outlook for the coming days and open the way for a new April natural gas contract low of at least $1.59.

Nevertheless, this is still a very tight call for the near-term because $1.69 held on a closing basis. Should prices rise above $1.74 early tomorrow look for another attempt to test and overcome $1.78. Settling above $1.78 will confirm a break higher out of the range and the double bottom that formed around $1.643. Such a move will shift odds in favor of challenging $1.83 and higher in the coming days.