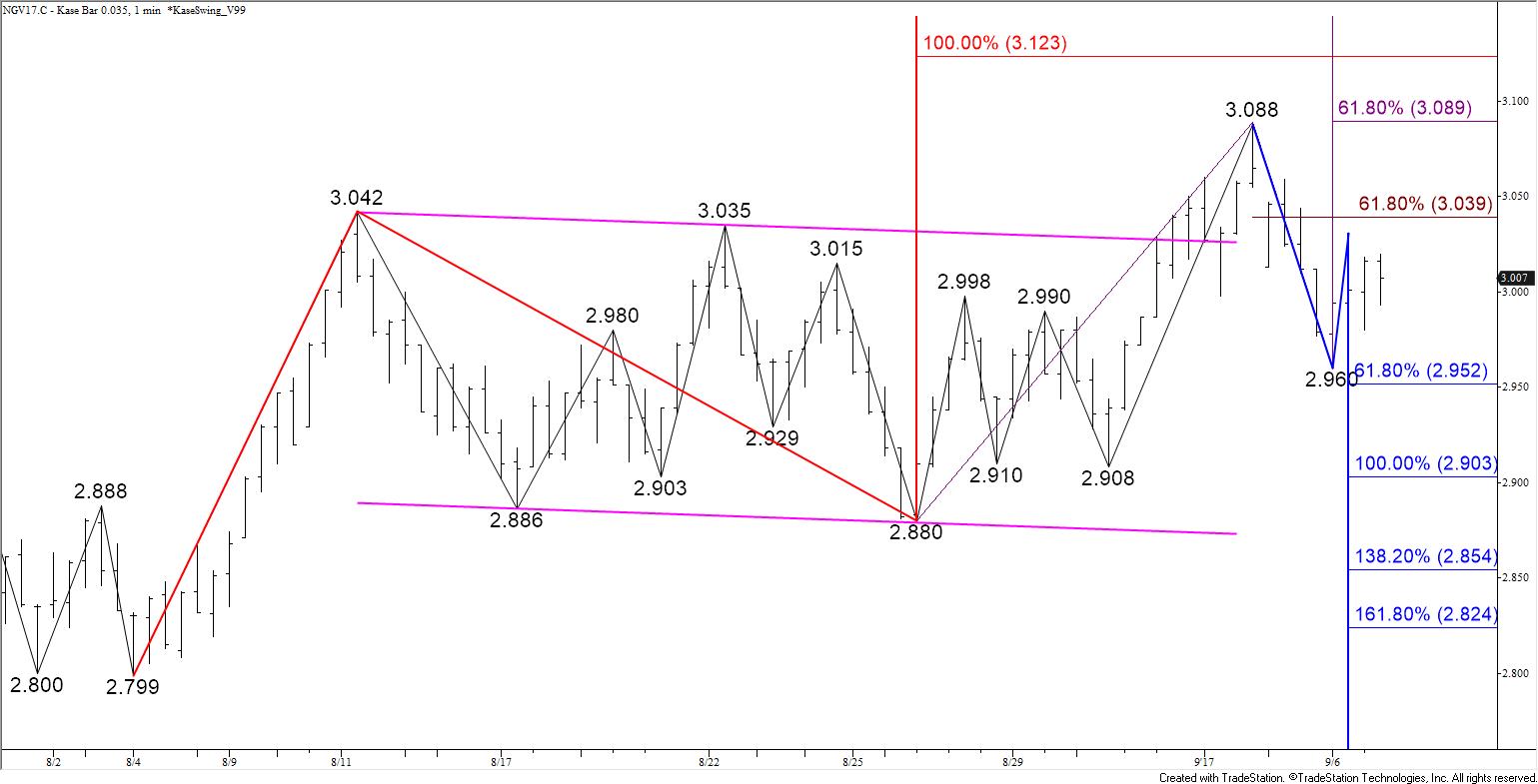

Monday’s gap up from $2.998 is probably a bullish breakaway gap for December natural gas. This is a reversal pattern that takes place after a prolonged down move or consolidation period. Breakaway gaps are also a good sign that a new trend has possibly begun. This type of gap is not usually filled like common gaps. However, in rare cases the breakaway gap may be filled and the new upward trend remain intact.

Today’s settle above the 100-day moving average, 62 percent retracement of the decline from $3.353, and $3.17 confluence point was positive for the medium-term outlook. The move up should grind its way higher to $3.20 and possibly $3.24 over the next few days. However, there are a few warning signs that indicate caution is warranted.

The move up stalled at $3.19, the 38 percent retracement of the decline from $3.747, and still looks a bit exhausted. This afternoon’s late pullback, intraday bearish divergences, and overbought daily Stochastic indicate a larger pullback might take place soon.

With all factors considered, even if a larger pullback takes place support at $3.06 is expected to hold. This would only be a 38 percent retracement of the move up from $2.847, which is considered a “normal” correction. This may even be healthy for the prospects of a longer-term recovery as it could bring in a new wave of value seeking buyers. It would also setup a wave up from $2.847 with which more meaningful confluence points could be projected.

The key to sustaining a positive outlook is holding the bottom of Monday’s gap up from $2.998. Closing below this, which in this case is also near the 62 percent retracement of the move up from $2.847 to $3.190, would indicate the move up has failed again and shift near-term odds back in favor of continued decline.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.