As WTI crude oil prices fall from the recent $51.67 high, some reports indicate the pullback is due to the rising U.S. dollar and increased rig counts for the second week in a row. Pundits have also stated the sharp price surge could encourage some producers to increase production, keeping the market oversupplied. Others still believe recent supply disruptions in Canada and Nigeria will be supportive.

From a technical perspective, WTI’s move up had become extended and was due for a correction. The confirmed dark cloud cover, bearish daily divergences, weekly shooting stars, and monthly evening star setups indicate the majority of technical factors are negative for the near-term.

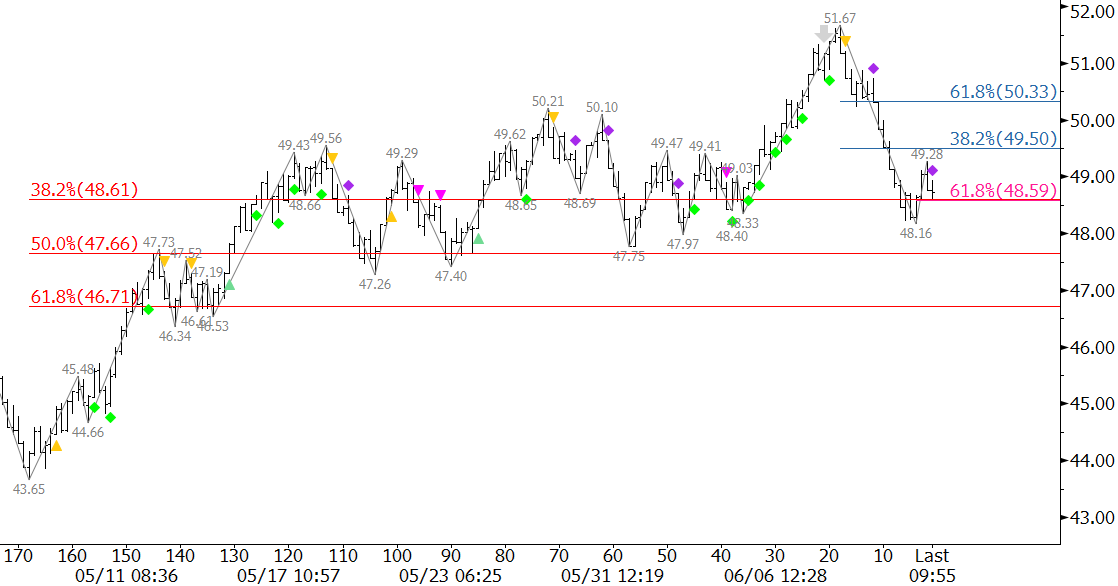

Support at $48.6 was challenged Monday, but held on the close. A move below $48.6 in early trading Tuesday would open the way for at least $47.7 and possibly $46.7. Both targets are near major swing lows that may hold initially. Therefore, we expect the move down will be choppy as it unfolds over the next few days.

There is a modest chance that Tuesday’s morning star setup will test Friday’s $49.8 midpoint first. This is near the 38 percent retracement of the decline from $51.67 to $48.16 and the 1.00 projection of the small wave up from $48.16. Key resistance is $50.3. This is the 62 percent retracement and 1.618 projection. Resistance at $50.3 is expected to hold. A close over $50.3 would call for prices to retest the $51.67 swing high.

This is a brief analysis and outlook for the next day or so. Our weekly Crude Oil Commentary is a much more detailed and thorough energy price forecast. If you are interested in learning more, please sign up for a complimentary four-week trial.