Early Monday, crude oil prices were bolstered again after an announcement made by non-OPEC producers to cut 558,000 barrels per day. This comes after a commitment by OPEC to cut 1.2 million barrels per day. Reports indicate that such cuts will help to rebalance supply and demand by the first half of 2017. However, many market insiders remain skeptical that OPEC and other major producers such as Russia will stick to their agreements and quotas in coming months.

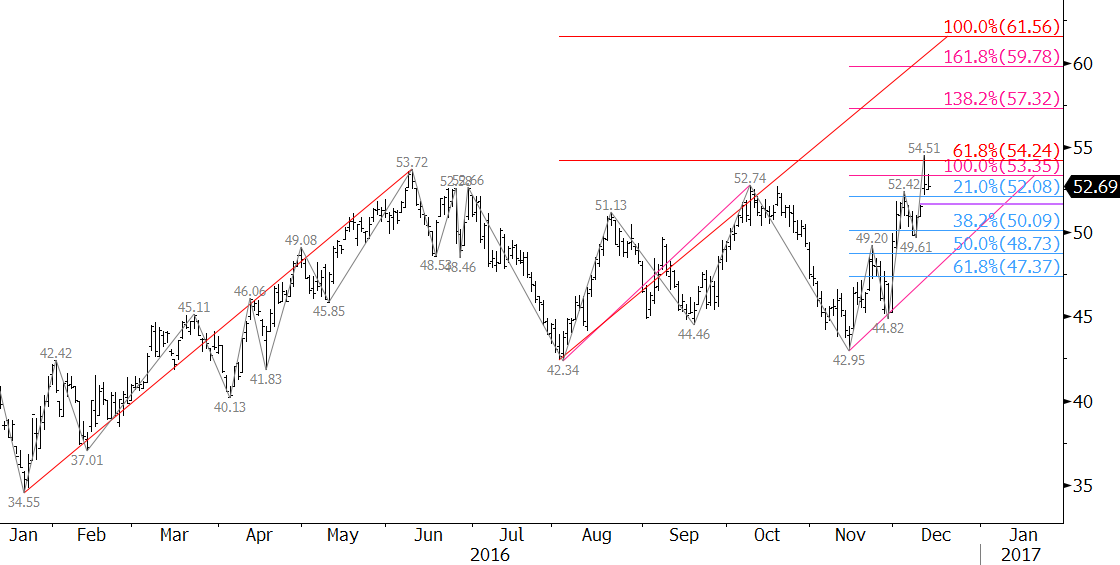

From a technical standpoint, January WTI gapped higher on Monday and met the 0.618 projection of the wave $34.55 – 53.72 – 42.43 at $54.51. This is an extremely important target. Waves that meet the 0.618 projection generally extend to their 1.00 projection, in this case, $61.6. It would likely take weeks, if not months, to reach $61.6. However, upon a sustained close over $54.5, the outlook for WTI would become much more bullish.

Due to the importance of $54.5, a correction is expected before prices rise much higher. So far, prices have fallen to $52.18 and formed a shooting star pattern on the daily chart. This is negative for the near-term and indicates the gap from $51.66 will most likely be filled within the next day or so.

A close below $51.66 would call for $50.1. This was resilient support last week and is the midpoint of December 1. For now, it looks as though prices will try and hold above $50.1 and will likely settle into a trading range between $50.1 and $54.5.

A close below $50.1 would open the way for $48.7 and $47.4. The lower of these two targets is most important support because it is the 62 percent retracement of the move up from $42.95 to $54.51. A sustained close below $47.4 is doubtful in the near-term but would be a strong indication that the move up is over.

This is a brief analysis and outlook for the next day or so. Our weekly Crude Oil Commentary and intra-week updates are a much more detailed and thorough energy price forecast. If you are interested in learning more, please sign up for a complimentary four-week trial.