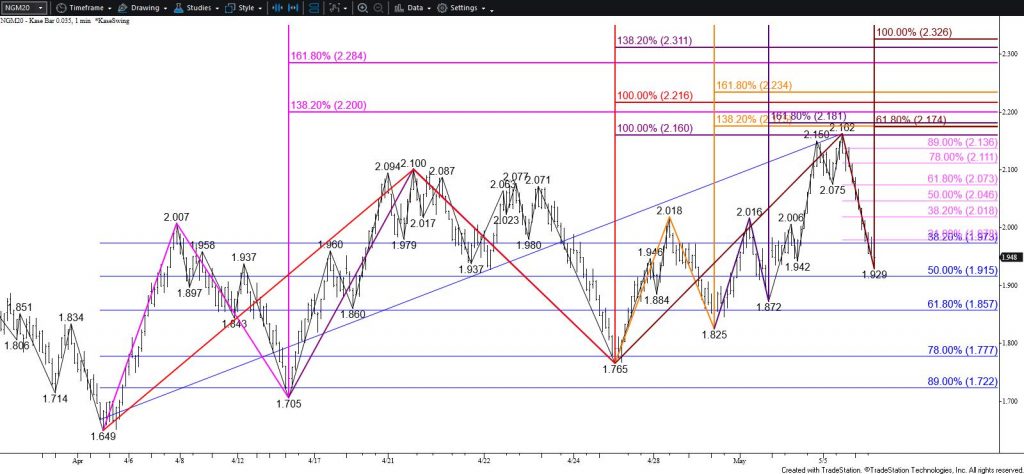

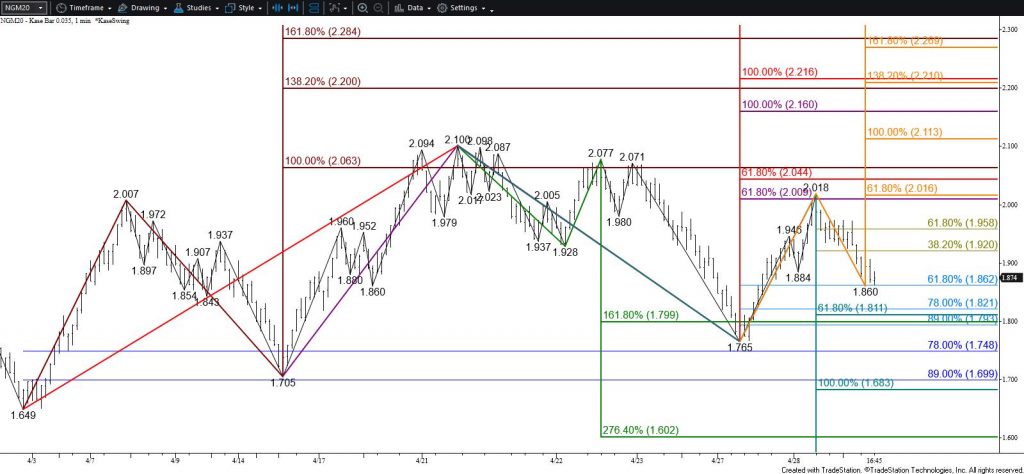

June natural gas broke support at $1.66 and fell to a new contract low of $1.595. Based on the waves and sub-waves down from $2.162 this is a highly confluent objective and a potential stalling point. Nonetheless, closing below $1.59 will call for $1.53, the last target protecting the continuation chart’s $1.519 swing low. Settling below $1.519 remains doubtful, but would clear the way for $1.45 and possibly $1.40.

There are no bullish signals or patterns that suggest the move down will end. However, the wave structure down from $2.162 lacks a definitive test of resistance and is due for an upward correction before prices push much lower.

Prices have risen late this afternoon and will probably challenge today’s $1.66 midpoint early tomorrow. Rising above this would call for a test of $1.71. For now, $1.71 is expected to hold, but a close above this would call for $1.81. This is the 38 percent retracement of the decline from $2.162 and must hold for the move down to extend during the next few days. Settling above $1.81 would imply the decline has stalled again and would call for a much more substantial test of resistance in the coming days and possibly weeks.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.