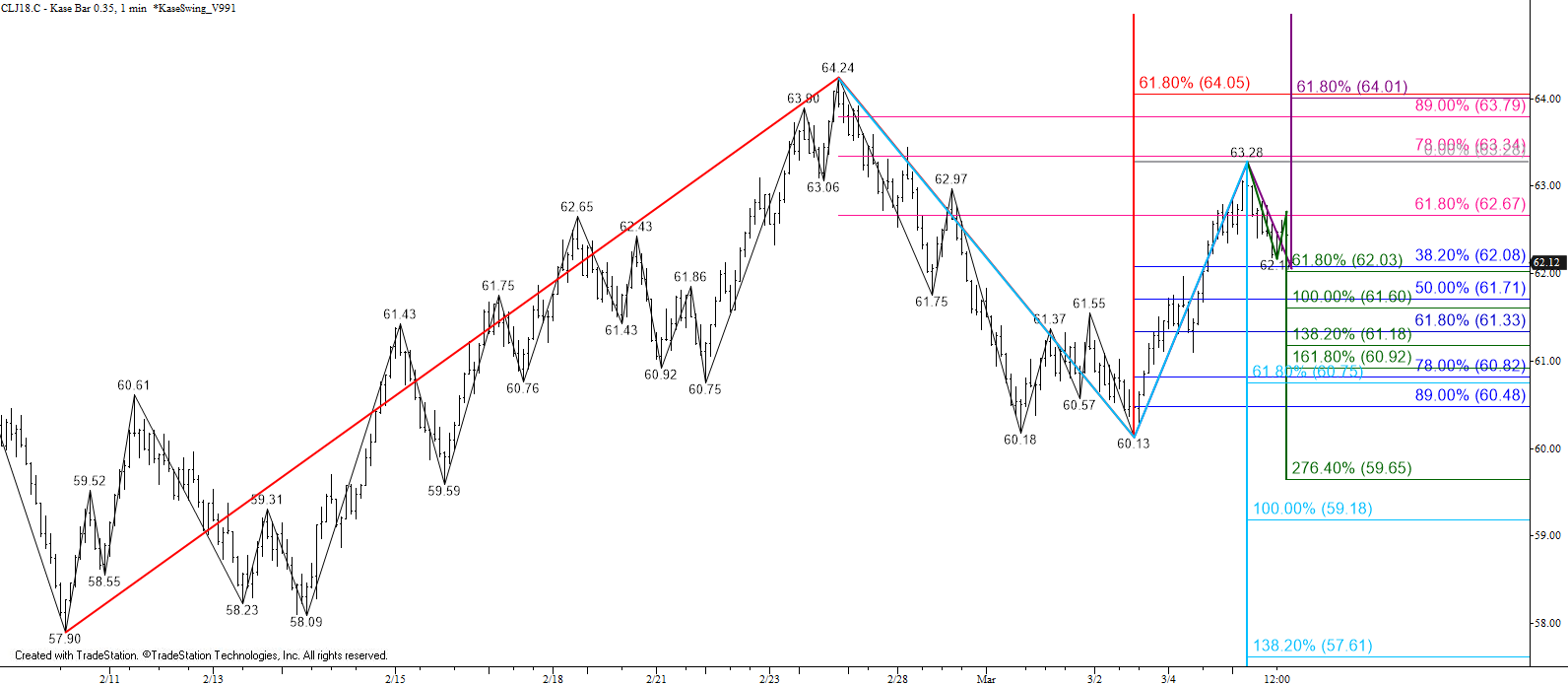

The long-term outlook remains slightly negative for WTI crude oil, but the near-term outlook seems to switch from positive to negative on a day-to-day basis. This generally reflects a market that is unsure of itself and could indicate a trading range is forming. For now, though, given today’s failure to settle above the equal to (1.00) target of the wave $60.13 – 61.97 – 61.1 and the 62 percent retracement of the decline from $64.24, odds have shifted in favor of testing support tomorrow.

The formation of a daily shooting star setup and wave formation down from $63.28 call for $62.0 and possibly $61.6 tomorrow. These are targets for the small wave down from $63.28 and the shooting star’s completion and confirmation points. A close below $62.0 would open the way for $61.1 and $60.7. The latter is most important because it is the smaller than target of the wave $64.24 – 60.13 – 63.28 and connects to $59.2 and lower.

Initial resistance at $63.0 should hold, but the key level for the near-term is $63.5. A close above this would call for $64.1, the smaller than target of the wave up from $57.9. This level is the key to a bullish outlook because a close above $64.0 would shift long-term odds in favor of a continued rise to $66.5 and higher.

This is a brief analysis for the next day or so. Our weekly Crude Oil Commentary and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.