WTI Crude Oil Technical Analysis and Short-Term Forecast

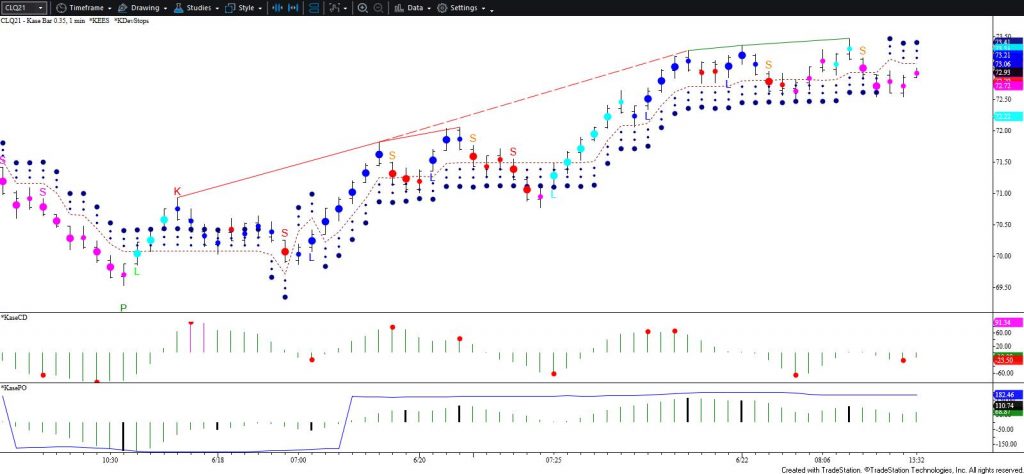

WTI crude oil is still poised to reach at least $73.7 and ultimately the next major objective at $75.0. However, today’s bearish doji warns that a test of support will probably take place first. Moreover, Kase StatWare formed a bearish KasePO (momentum) divergence and a short warning signal on a $0.35 Kase Bar chart. Support at $72.1 will likely hold and $71.2 is key support for the near term. Closing below $71.2 will confirm the bearish doji and shift near-term odds in favor of $70.6 and likely a test of $69.8 before the move up continues.

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial