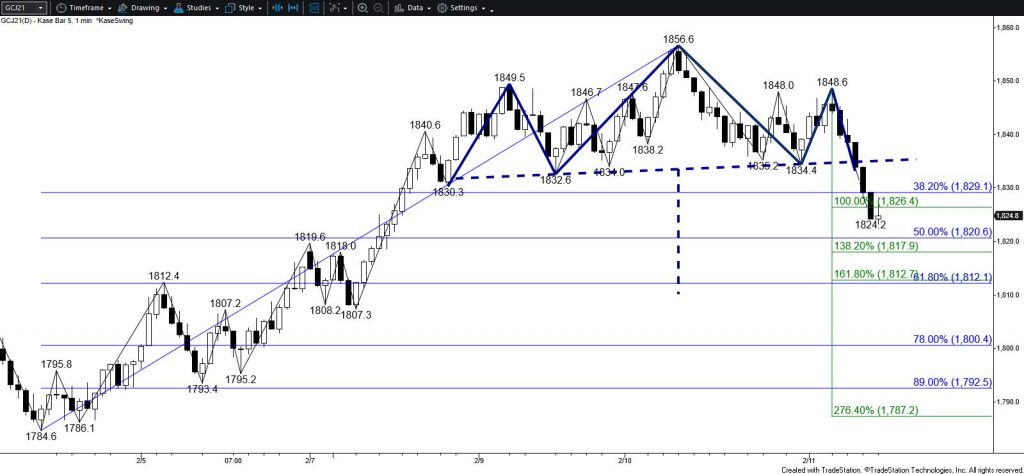

Gold Technical Analysis and Near-Term Outlook

Gold is poised to decline. Today’s move down formed a bearish engulfing line and broke the neckline of an intra-day complex head and shoulders reversal pattern. Furthermore, the decline took out the $1826 equal to target of the wave down from $1856.6 and the 38 percent retracement of the rise from $1784.6. Gold is now positioned to fall to $1812. This is in line with the larger than (1.618) target of the wave down from $1856.6, the 62 percent retracement of the rise from $1784.6, and the complex head and shoulders’ target. Closing below $1812 might initially prove to be a challenge but will clear the way for the next major objectives at $1776 and $1759.

Nevertheless, the move down might still prove to be corrective. This has become doubtful given the combination of bearish technical factors today. However, a close above $1843 will call for the $1848.6 swing high to be overcome. This would invalidate the complex head and shoulders and call for a test of key near-term resistance at $1861. Settling above $1861 would shift near-term odds in favor of challenging $1877, which is now split between the 100- and 200-day moving averages. This level is the last level of resistance before a $1901 bullish decision point.

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.