WTI Crude Oil Price Forecast

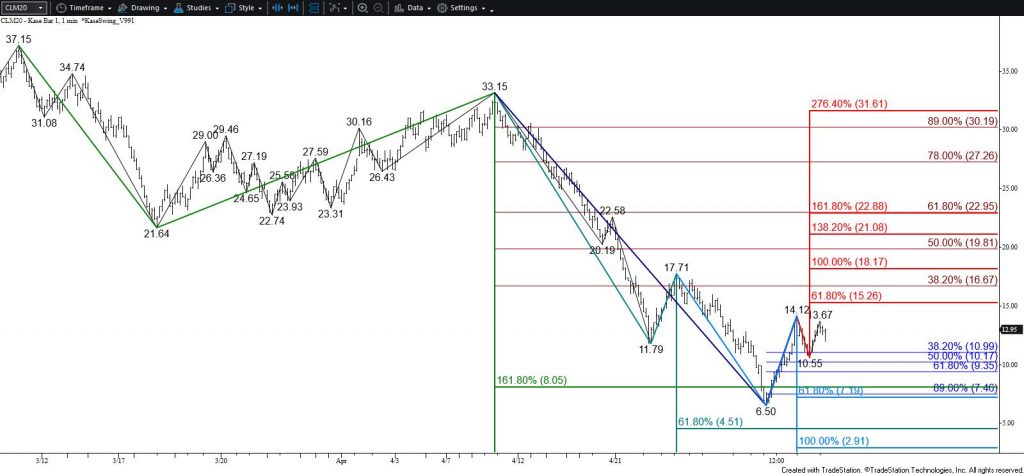

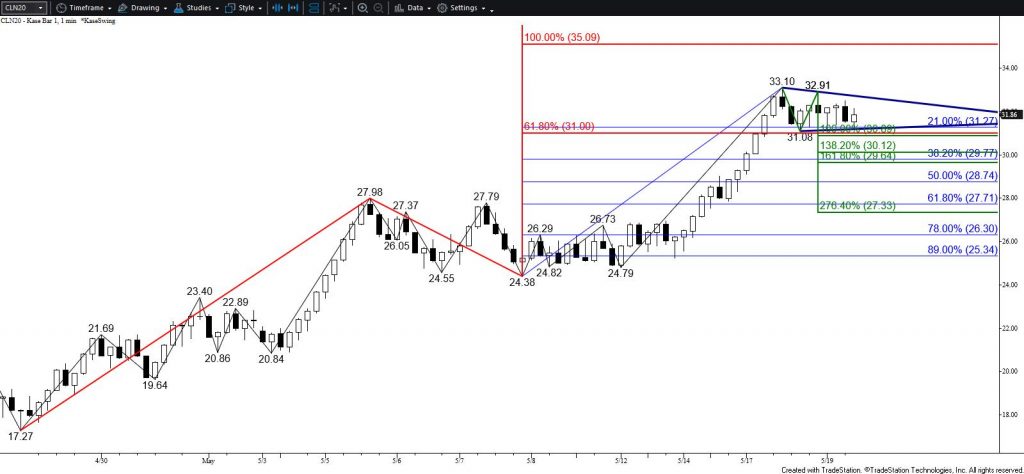

The long-term outlook for WTI crude oil is bullish, and based on technical factors, the move up is still poised to challenge the next major objective at $35.1. However, several daily momentum oscillators are overbought, and today’s evening star setup suggests the move up is nearing exhaustion. The challenge, however, is that on the intra-day chart the evening star forms a bullish pennant. Pennant’s normally break in the direction of the trend, in this case, up. A close above $32.6 will confirm a break higher and clear the way for $33.3, $34.2, and possibly $35.1 during the next few days.

Nevertheless, July WTI’s wave structure up from $17.27 is due for a larger test of support before overcoming $35.1. Also, due to the overbought momentum conditions, this is a case where the bullish coil may fail. Any move down will most likely be corrective and should attract new buyers. Even so, should WTI fall below $31.2, look for $30.8 and possibly $29.9. Closing below $29.9 will open the way for $28.7 and possibly lower before the move up ultimately continues.

Brent Crude Oil Price Forecast

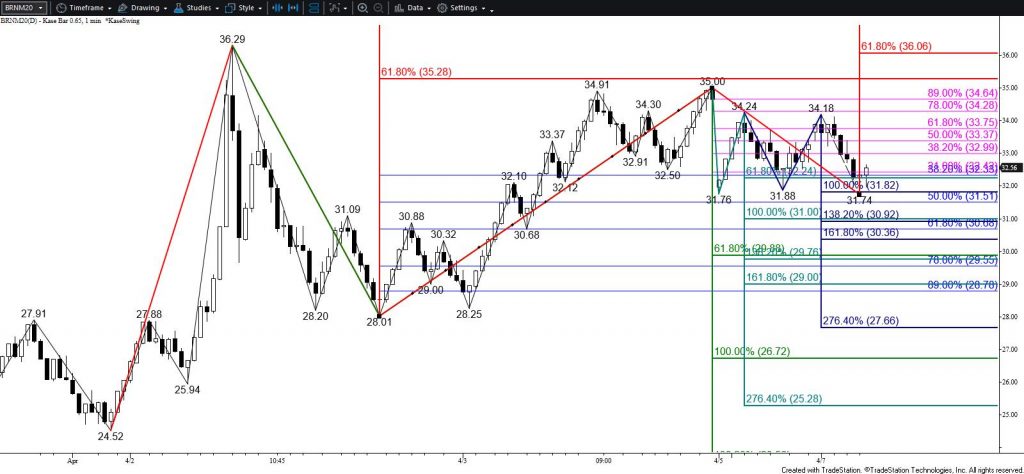

Brent leans a little less bullish than WTI for the near-term, but the overall outlook remains bullish. A move above $35.7 will clear the way for a push toward $36.5 and $37.7 during the next few days.

That said, daily momentum oscillators are overbought, and today’s evening star setup suggests that there is a good chance Brent’s corrective move down from $35.76 will extend first. Support at $33.8 is expected to hold and $32.9 is key. Settling below $32.9 will shift near-term odds in favor of $31.8 and possibly $31.0 before the move up continues.

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial