WTI Crude Oil Technical Analysis and Short-Term Forecast

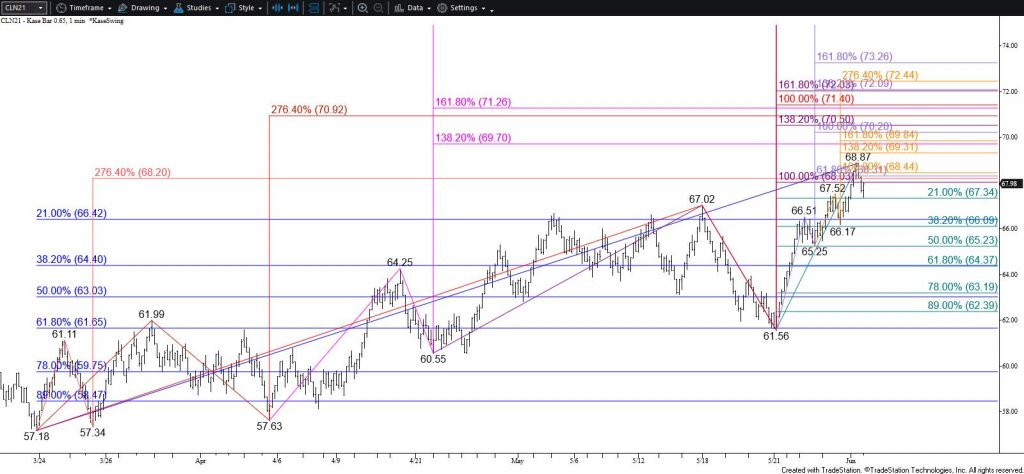

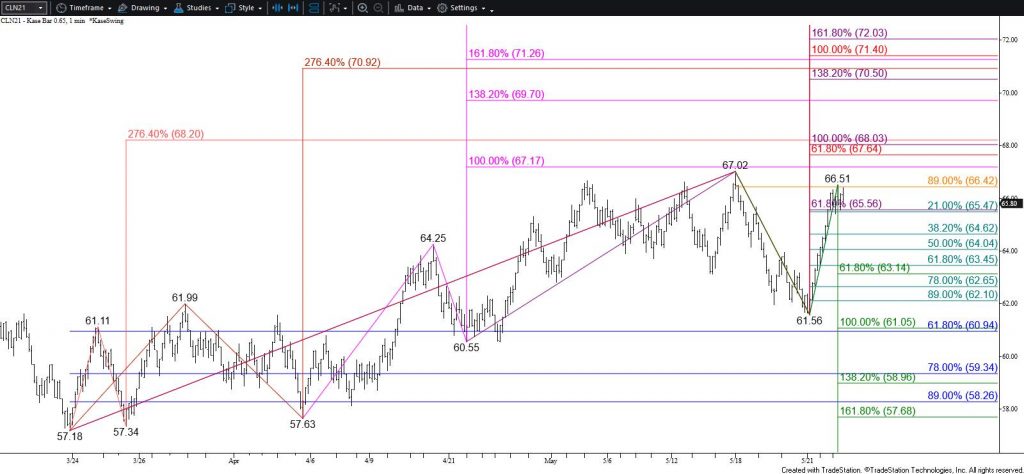

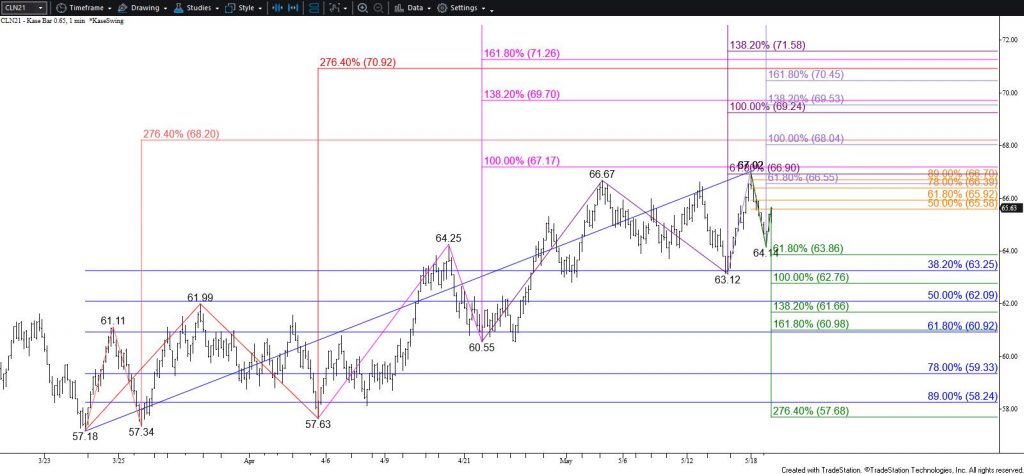

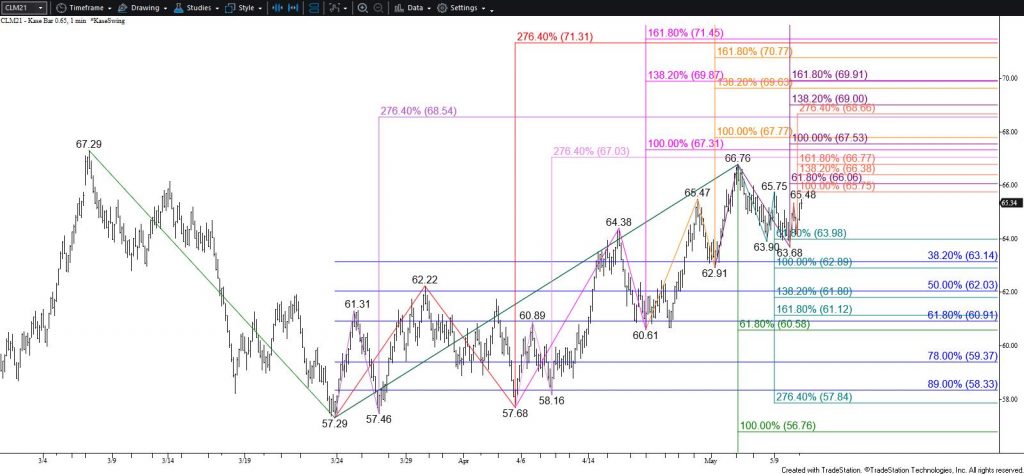

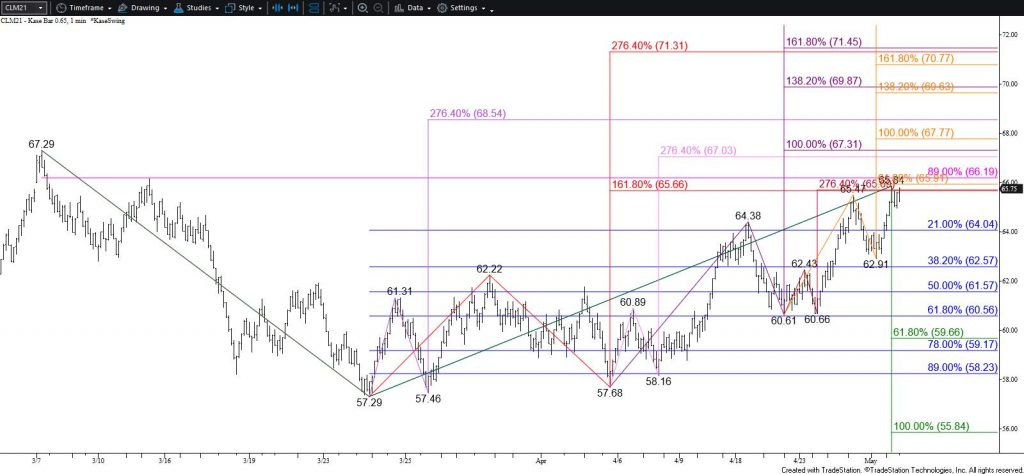

WTI crude oil fell to challenge support at $68.7 as expected before rallying above the psychologically important $70.0 level. Prices settled just above $70.0 and are rising in post-settlement trading hours. There is immediate an immediate target at $70.4, but the move up is poised to reach $71.2 during the next day or so.

The $71.2 target is a highly confluent objective and potential stalling point for WTI. However, there is no technical evidence that calls for a major reversal. Therefore, any move down will most likely prove to be corrective. Initial support is $69.3 and key near-term support is $68.3. Settling below $68.3 would call for a deeper test of support before the uptrend continues.

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.