WTI Crude Oil Technical Analysis and Short-Term Forecast

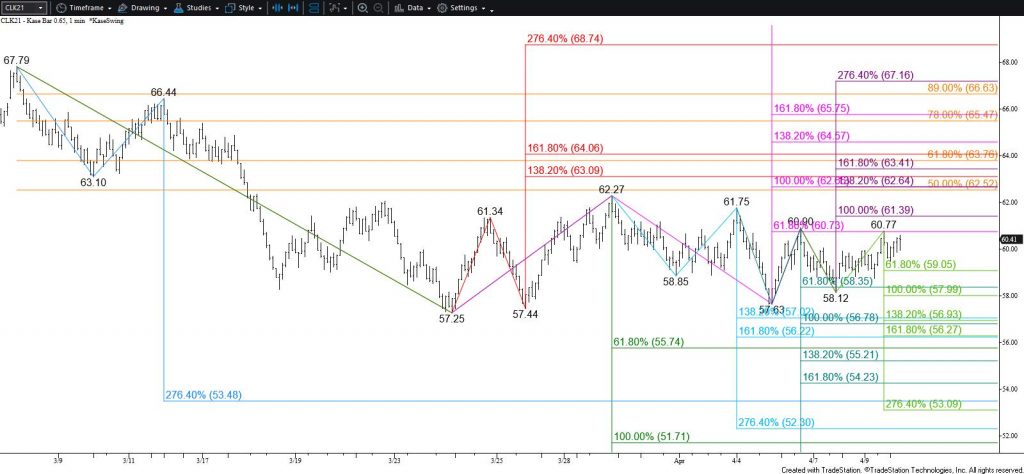

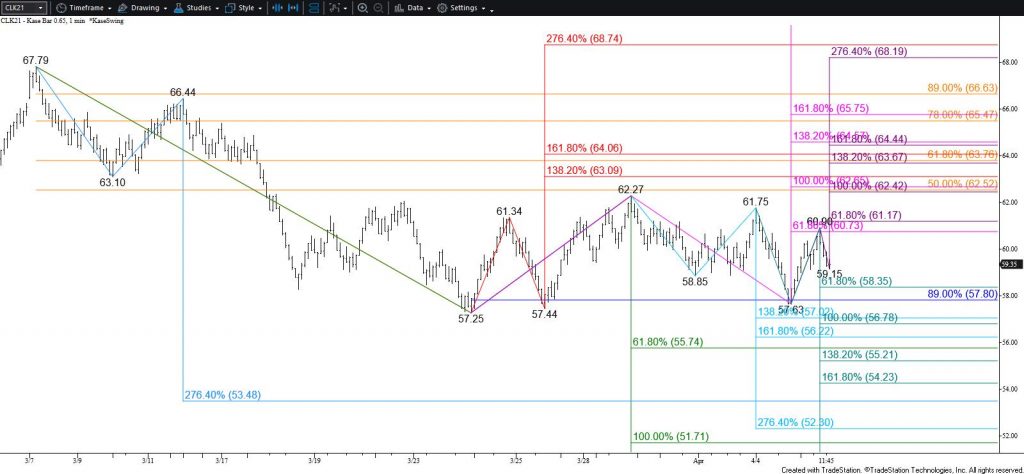

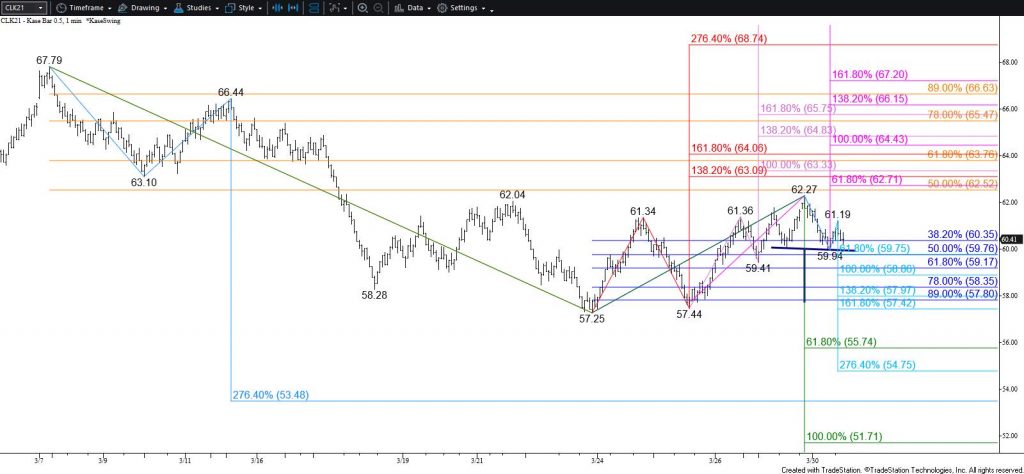

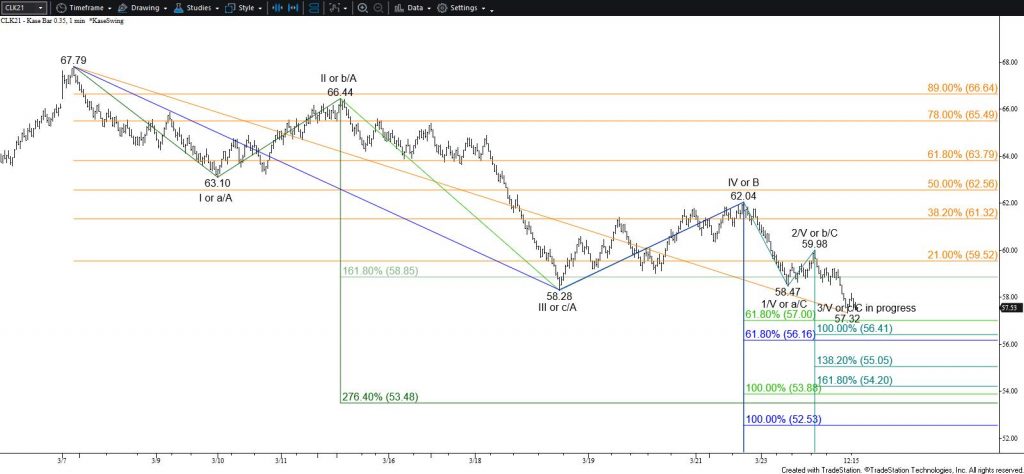

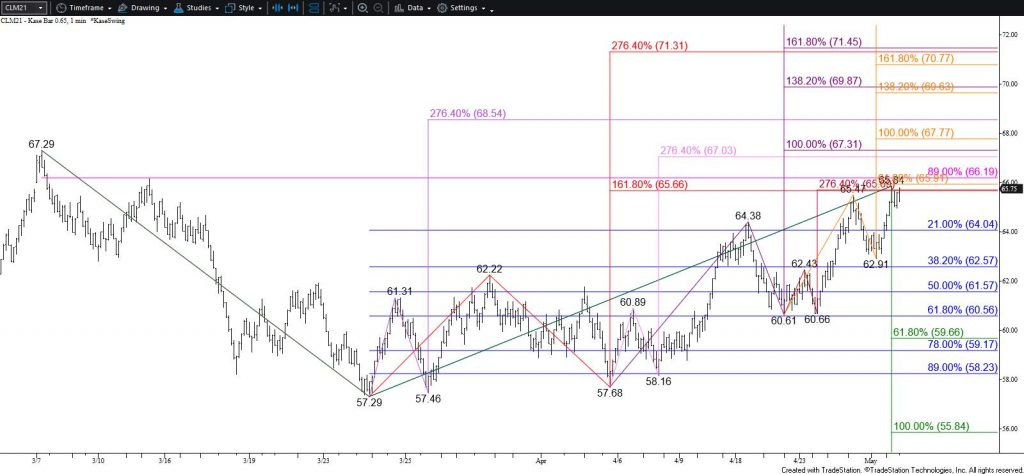

The outlook for WTI crude oil remains bullish after overcoming the $65.47 swing high and challenging the $65.7 target today. This is a potential stalling point because $65.7 is the larger than (1.618) target of the primary wave up from $57.29, the XC (2.764) projection of a subwave up from $60.61, and is in line with the smaller than (0.618) target of a compound wave up from $60.61. Furthermore, a small intraday double top might be forming around $65.8.

Nevertheless, any move down will most likely prove to be a short-lived correction. Moreover, a move above $65.84 early tomorrow will negate the potential double top and call for at least $66.7 and possibly the next major objective at $67.7 during the next day or so. The $67.7 objective is the most confluent target on the chart and is crucial because it ties the waves up from $57.29 to the wave structure before the $67.29 swing high. Settling above $67.7 will clear the way for $69.1 and $70.1.

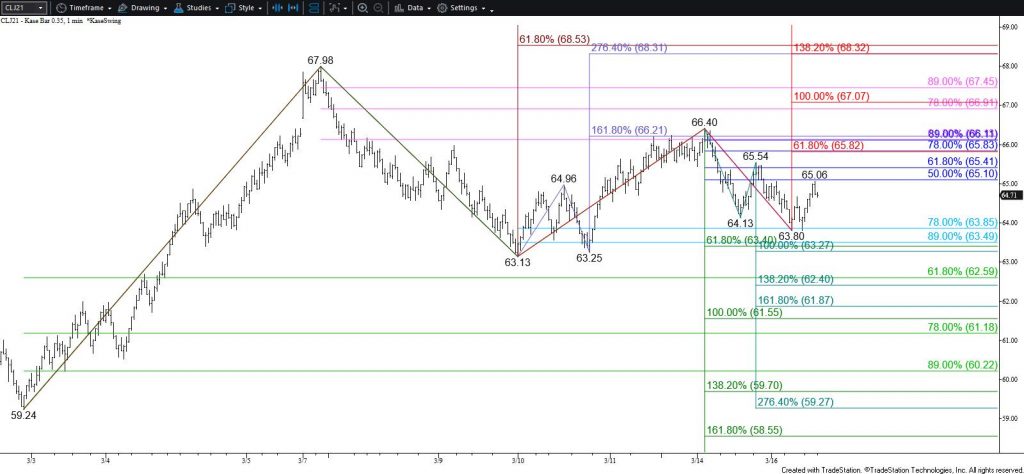

With that said, should WTI take out the $64.96 swing low first, the potential $65.8 double top would be confirmed. This would then call for a test of $64.2, which is in line with the pattern’s target, today’s open, and the 21 percent retracement of the rise from $57.29. Support at $64.2 is expected to hold, but a close below this will call for a test of key near-term support at $62.6. Settling below $62.6 is doubtful but would reflect a bearish shift in near-term sentiment.

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.