WTI Crude Oil Technical Analysis and Short-Term Forecast

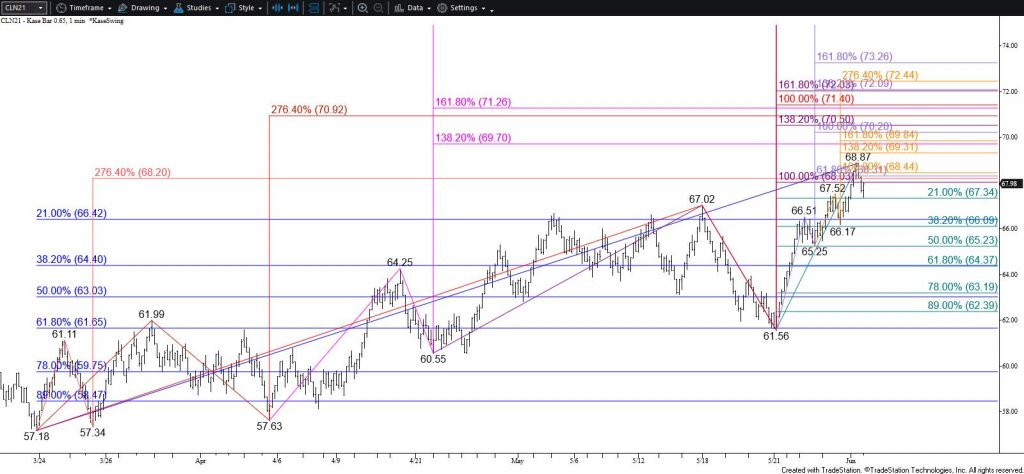

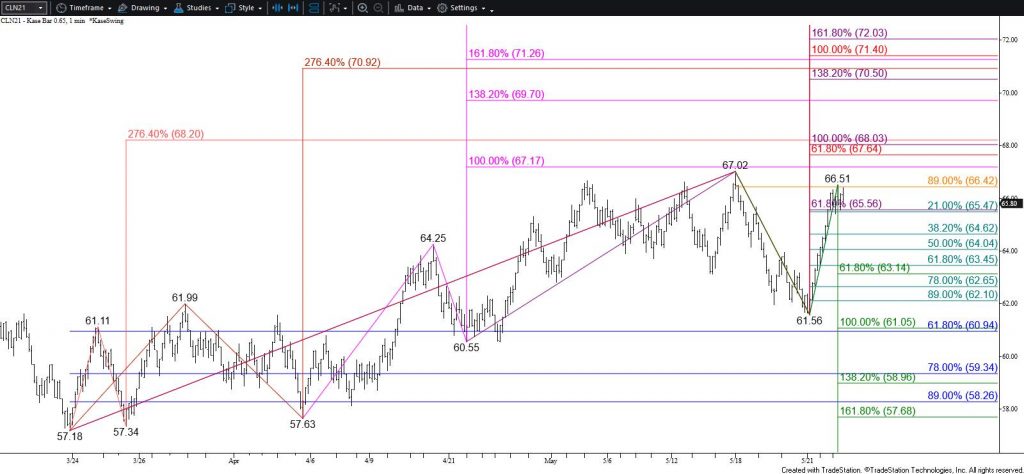

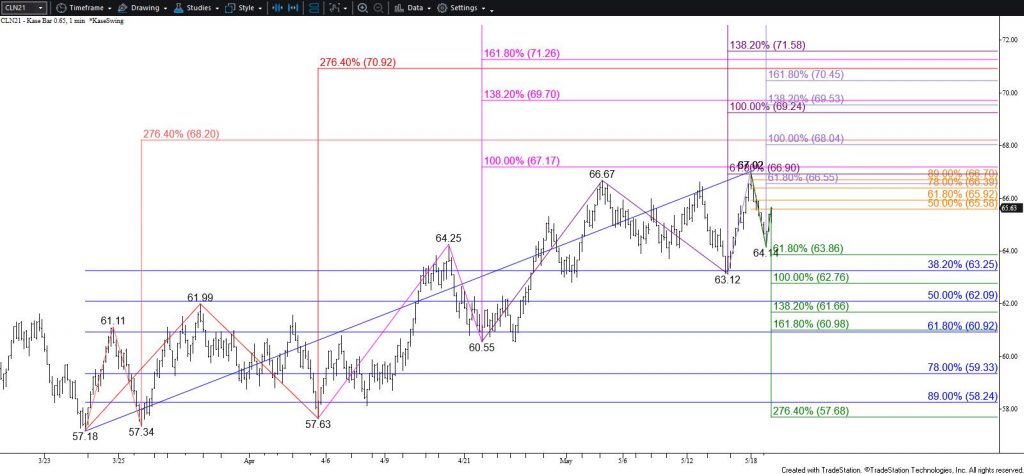

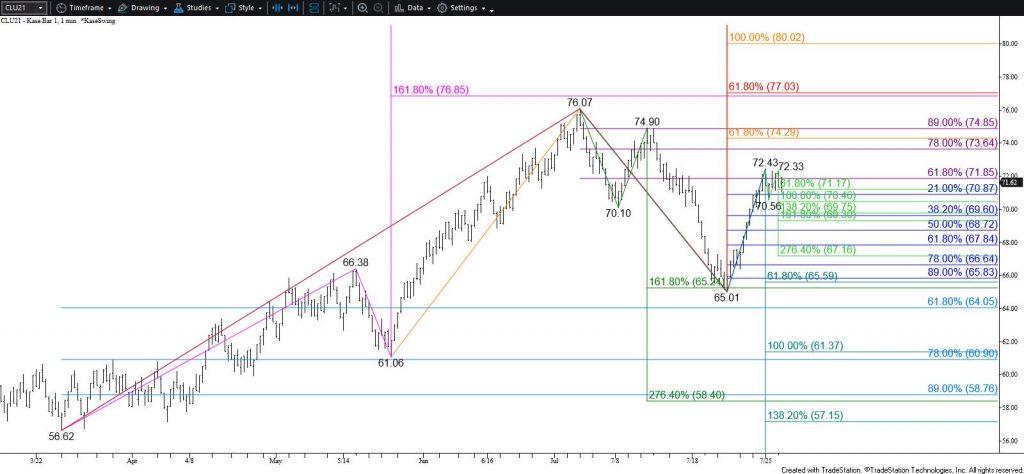

The outlook for WTI crude oil remains bullish. The move up is somewhat exhausted though and is struggling to definitively overcome the 62 percent retracement of the decline from $76.07 at $71.9. Even so, rising above $72.2 before falling much lower will clear the way for $72.9 and likely $73.8 and higher in the coming days.

With that said, three daily dojis, one of which is a hanging man, and the wave formation down from $72.43 suggest a test of at least $70.4 and possibly $69.6 will probably take place first. Closing below $69.6 is doubtful but would shift near-term odds in favor of a deeper test of support where $67.8 is the barrier to a firmer bearish outlook.

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.