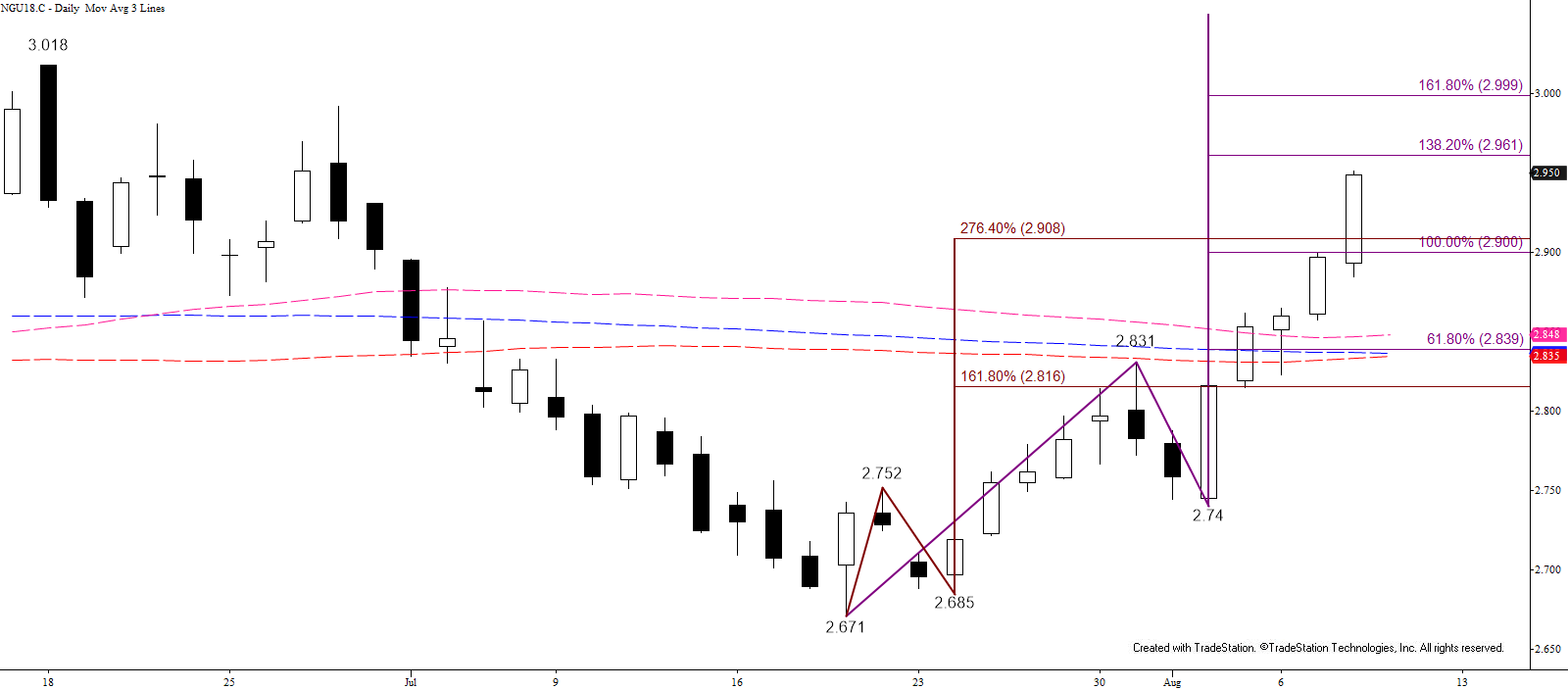

Natural gas has adopted a much more positive near-term bias during the last week and is pushing toward key thresholds that could open the way for a longer-term bullish outlook. Today’s settle above $2.94, the upper end of the tolerance range around this week’s $2.91 target, calls for a test of $3.00. There is immediate resistance at $2.96 but $3.00 is now the next major objective. A close above this would be long-term bullish, calling for $3.10 and higher.

That said, the move up is becoming somewhat extended and a pullback to test support should take place before prices overcome $3.00. Such a move would likely be corrective and should hold $2.88 support. Key support for the near-term is $2.85, an important retracement of the move up from $2.671 and $2.74, which is also in line with the 50-day moving average. Settling below this would be a likely reflection of a negative shift in underlying fundamentals. For now, though, while $2.85 holds any move down will present a short-term buying opportunity that could become a longer-term uptrend upon a close over $3.00.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.