Natural Gas Technical Analysis and Near-Term Outlook

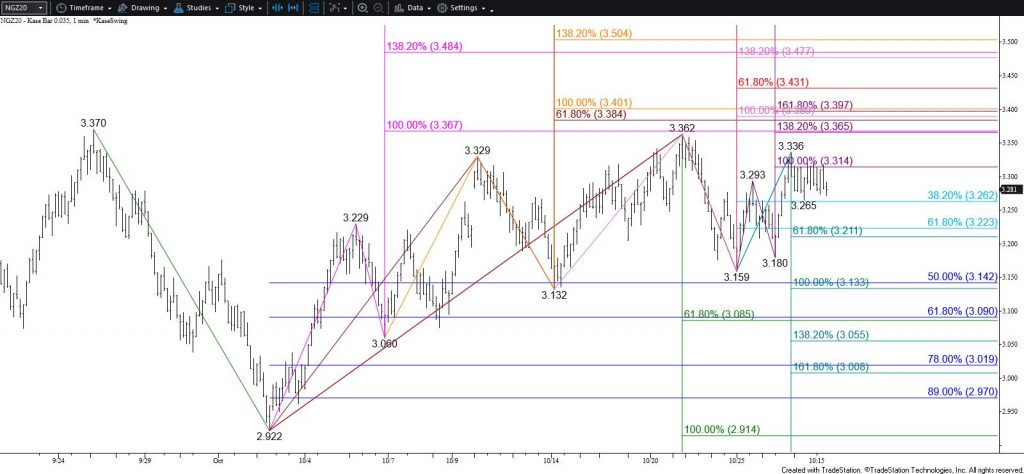

The near-term outlook for natural gas leans bullish. However, this is still a tight call because the $3.37/$3.362 double top is still intact and this week’s move up stalled near the equal to (1.00) target of the wave up from $3.159. Also, today’s Harami candlestick is negative and the wave down from $3.336 met its smaller than (0.618) target this afternoon. Therefore, a test of $3.25 and possibly $3.22 is expected before overcoming $3.33. This implies that trading will most likely remain range-bound for another few days before the move up continues.

Closing above $3.33 will call for a test of key resistance at $3.37. This is the most confluent target on the chart, a close above which will negate the double top and clear the way for $3.43 and higher.

For natural gas to overcome $3.37 during the next few days, support at $3.22 must hold. Closing below this will take out the smaller than target of the wave down from $3.362, which would call for a test of the $3.13 equal to target. This level is crucial for the near-term because a close below $3.13 will call for $3.09. This is the 62 percent retracement of the rise from $2.922 and the smaller than target of the wave down from $3.37. Settling below $3.09 would clear the way for a test of $3.01 and possibly lower.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.