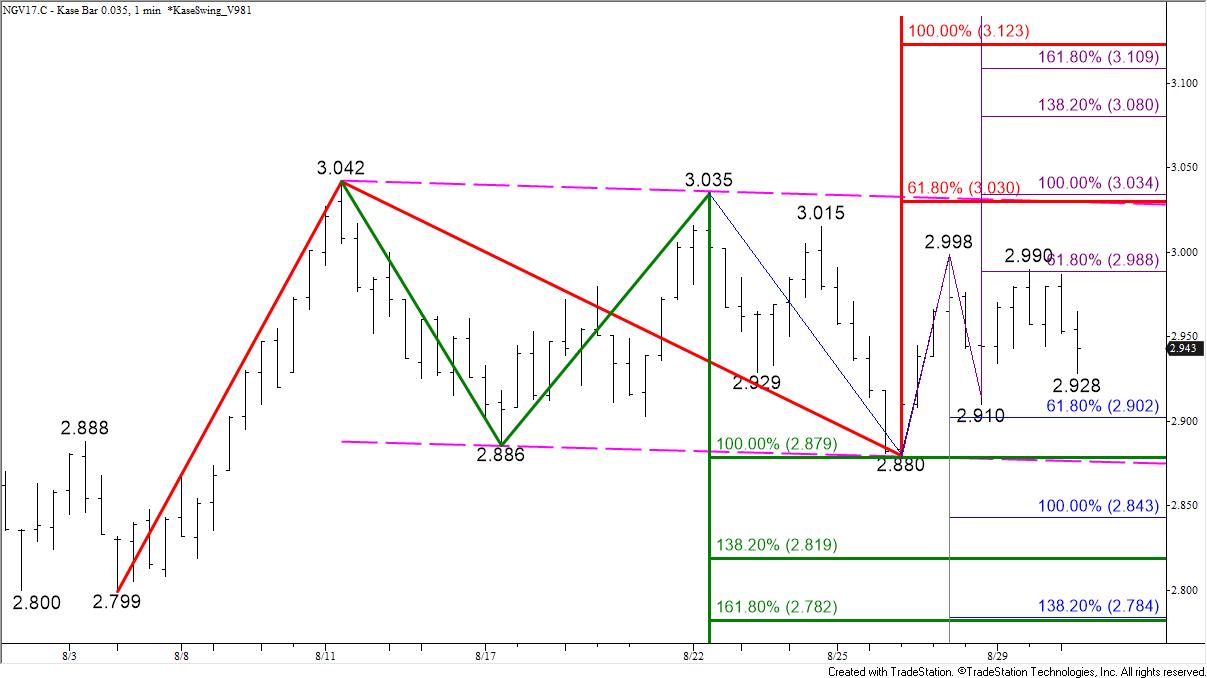

October natural gas looks to be well balanced as it continues to oscillate in a range between nominally $2.88 and $3.03. The range forms a bullish flag after holding support at $2.88 on Monday. However, today’s early move up stalled before it could overcome the $2.998 swing high and challenge the flag’s $3.03 upper trend line.

Flags are generally reliable continuation patterns. However, in this case, we believe there is a high probability that $3.03 will hold and that ultimately prices will break lower out of the pattern. This is because the pattern has been very wide relative to the prior move up from $2.799 to $3.042. In addition, prices have not been able to overcome the psychologically important $3.00 level for the past few days.

Because the wave $2.88 – 2.998 – 2.91 met its $2.99 smaller than (0.618) projection there is still a reasonable chance for a test of $3.03. However, a move below the $2.91 swing low would wipe out that wave and significantly dampen the odds for $3.03 and higher. Therefore, at this point, a move above either $2.99 or below $2.91 should give us a good idea of the direction for the next few days.

The market remains tight and may continue to oscillate in a narrowing range, but with all factors considered, tomorrow look for a test of $2.90 and possibly $2.87. A close below $2.87 would confirm a break lower out of the flag, opening the way for $2.84 and lower.

Should the $2.91 swing low hold and prices overcome $2.99, near-term odds will shift back in favor of challenging $3.03. A close above $3.03 would confirm a break higher out of the flag and call for $3.08 and ultimately $3.12.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.