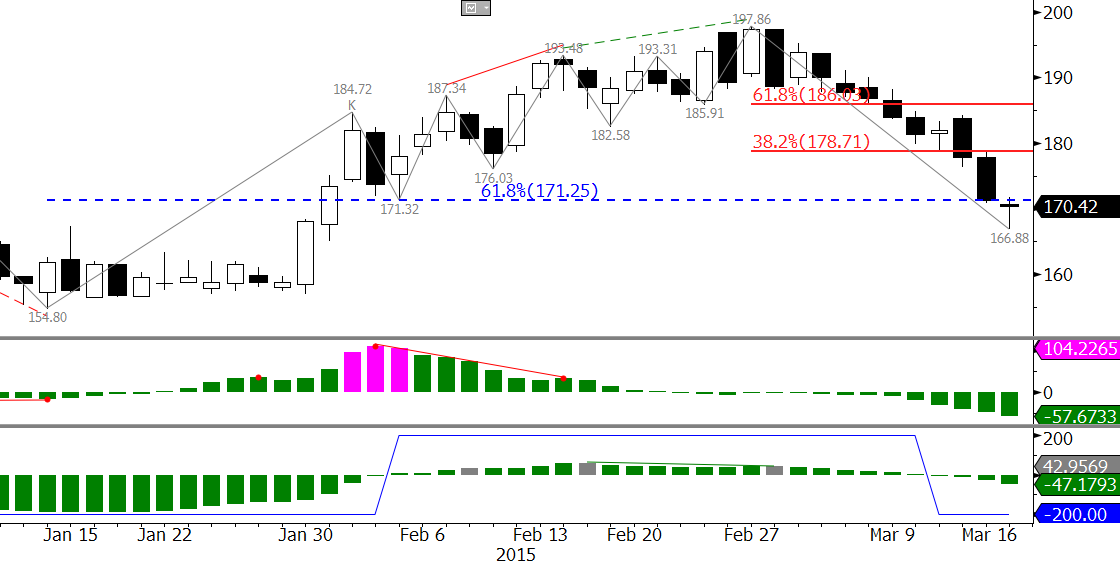

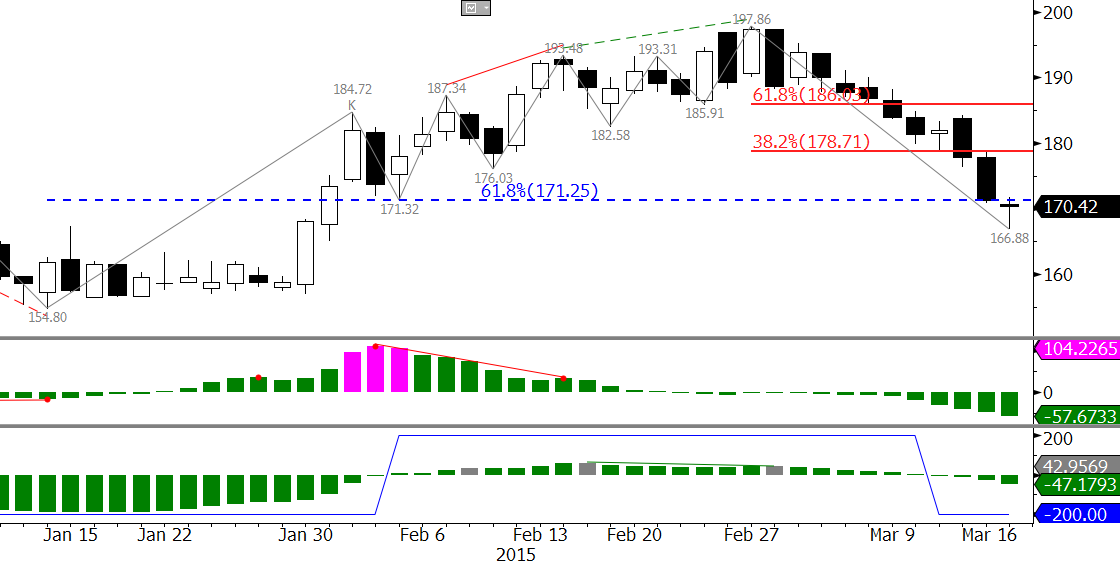

NY Harbor ULSD futures fell to a new intraday low for the eighth session in a row, but formed a bullish morning star setup and hammer. These are bullish reversal formations, but in this case it is more likely that a subsequent move up will be a correction rather than a reversal. In addition, the decline stalled near the 62 percent retracement of the move up from 154.8 to 197.86, which supports the likelihood of a correction. However, the KasePO and KaseCD show that the decline should ultimately continue. Look for resistance at 178.7 and no higher than 186.0 to hold.

Take a trial of Kase’s energy forecasts.

Published by

Dean Rogers, CMT

Dean Rogers, CMT is the President of Kase and Company, Inc. He oversees all of Kase's operations including research and development, marketing, and client support. Dean began his career with Kase in early 2000 as a programmer but developed into Kase’s senior technical analyst and became President of the company in January 2024. He writes Kase’s award-winning weekly Crude Oil, Natural Gas, and Metals Commentaries. He is an instructor at Kase's classes and webinars and provides all of the necessary training and support for Kase's hedging models and trading indicators for both retail and institutional traders.

View all posts by Dean Rogers, CMT