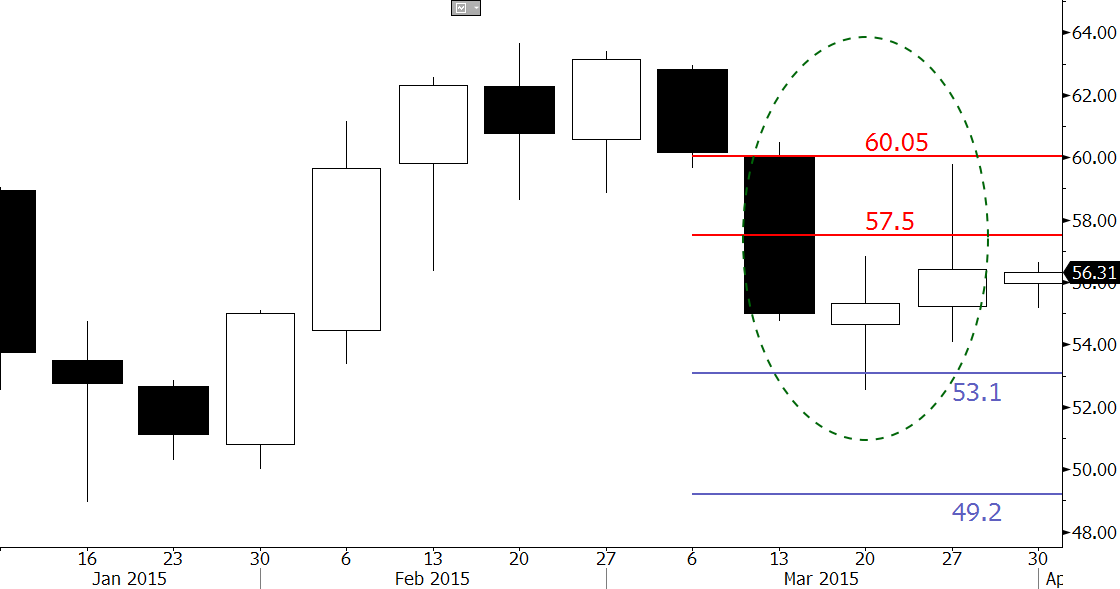

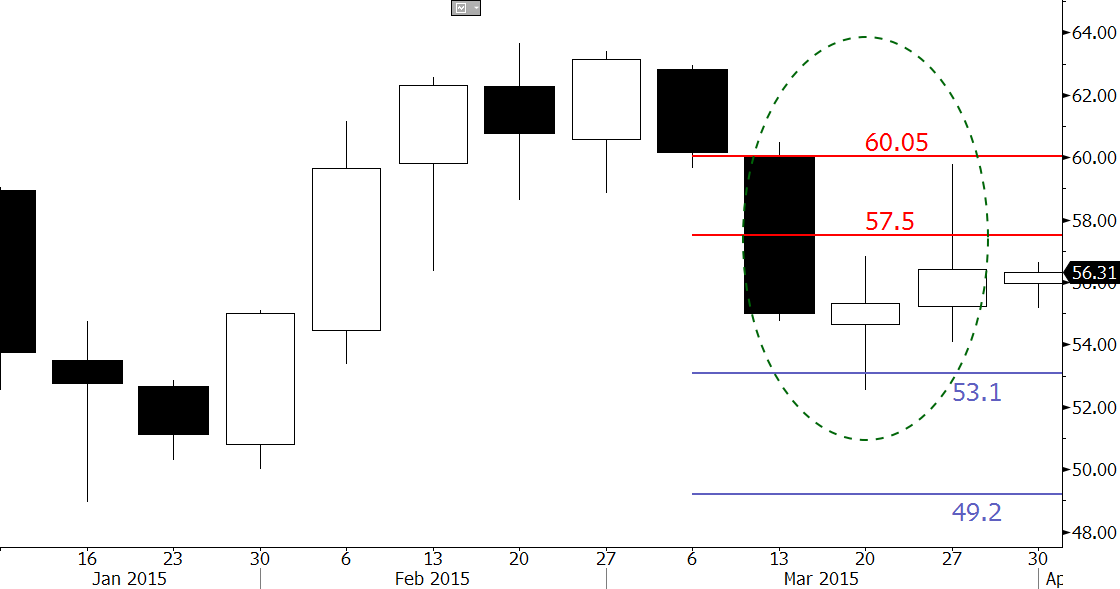

Brent crude’s failure to close above the $57.5 completion point of the weekly morning star setup (circled in green) was negative and indicates the geopolitically driven move up that took place last week may be short lived. The Brent crude price rose modestly on Monday, but most short-term technical factors indicate it should test $53.1 again. A close below this would call for $49.2, which is the last target protecting the $48.95 contract low.

Look for resistance at $57.5 and $60.05. A close over the latter would open the way for the $63.66 swing high to be challenged.

Take a trial of Kase’s weekly WTI and Brent Crude Oil Price Forecast.

Published by

Dean Rogers, CMT

Dean Rogers, CMT is the general manager of the Kase Call Center in Albuquerque, New Mexico. He oversees all of Kase and Company, Inc.’s operations including research and development, marketing, and client support. Dean began his career with Kase in early 2001 as a programmer but has developed into Kase’s senior technical analyst. He writes Kase’s award-winning weekly Crude Oil, Natural Gas, and Metals Commentaries. He is an instructor at Kase's classes and webinars and provides all of the necessary training and support for Kase's hedging models and trading indicators for both retail and institutional traders.

View all posts by Dean Rogers, CMT