WTI Crude Oil Technical Analysis and Short-Term Forecast

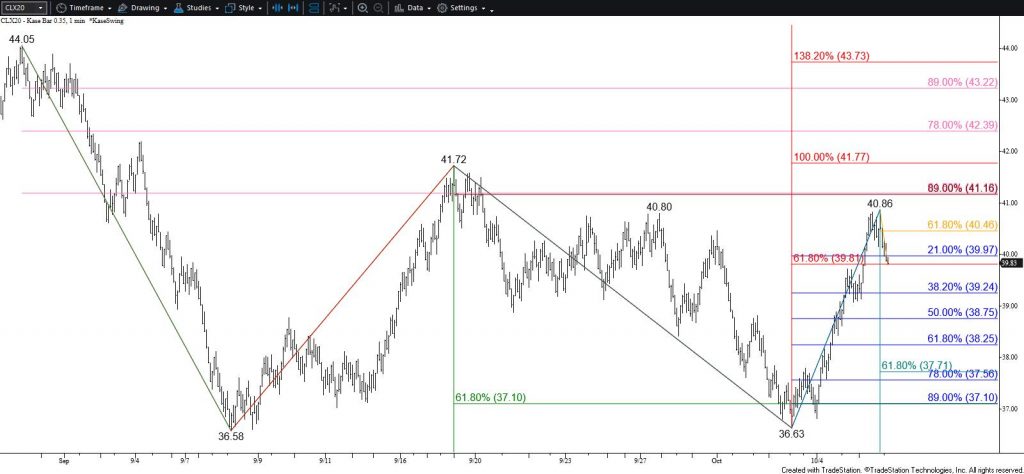

The quantitative outlook for WTI crude oil has become muddled during the past couple of days. Even so, longer-term odds will continue to lean bearish while the $41.72 swing high holds. A deeper test of support is expected tomorrow but given the tug-of-war between bullish and bearish technical factors, there is a good chance that WTI will settle into a trading range for a few days while it sorts through external factors.

WTI crude oil’s post-settlement decline has formed a long upper shadow on the daily candlestick and drove prices back below the 100-day moving average. Although the daily candlestick won’t reflect this due to the $40.67 settlement, the decline is negative for tomorrow’s forecast and calls for a deeper test of support.

Additionally, this afternoon’s decline also confirmed an intra-day double top between the $40.83 and $40.86 swing highs that was confirmed by the move below the $40.15 swing low. The target for this small pattern is $39.5, but the more important confluence point is $39.2. This is the 38 percent retracement of the rise from $36.63 and connects to $38.3, the 62 percent retracement. For the move up to have a reasonable chance at continuing during the next few days $38.3 must hold. Closing below $38.3 will call for $37.7 and then $37.0, the latter of which is the barrier to a much more bearish outlook.

With that said, the challenge is that today’s move up overcame the $40.80 swing high and invalidated all of the subwaves down from $41.72 that called for a bigger decline. More importantly, WTI settled above the $39.8 smaller than (0.618) target of the wave up from $36.58. This implies that WTI might rise to challenge the $41.8 equal to (1.00) target. This would take out the $41.72 swing high and invalidate the larger wave down from $44.05 that settled below its $37.10 smaller than target on Friday. This wave calls for a decline into the mid-to-low $30s. Therefore, this is the cause of what will likely be become a tug-of-war between bulls and bears during the next few days.

Should WTI overcome $40.5 early tomorrow look for a test of $41.2 and possibly $41.8. As stated, rising to $41.8 would invalidate the primary wave down from $44.05 and shift longer-term odds in favor of a continued rise.

Brent Crude Oil Technical Analysis and Short-Term Forecast

Brent crude oil stalled at the 100-day moving average and formed a double top around $43.84. This pattern was confirmed by this afternoon’s decline below $42.12 and calls for a test of $41.3 tomorrow. This is near the double top’s target and the 38 percent retracement of the rise from $38.79. Settling below $41.3 will call for $40.3 and possibly $39.4. The $39.4 objective is most important but will likely hold for now because it looks as though Brent will settle into a trading range for a few days before committing to a longer-term directional move.

Nevertheless, should Brent overcome $43.0, look for a test of $43.9 and then $44.5. Rising to $44.5 would take out the $44.3 swing high and invalidate the primary wave down from $46.99 that took out its $39.91 smaller than target on Friday. Overcoming $44.3 would strongly imply that the move down is over and that a longer-term bullish recovery is underway.

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.