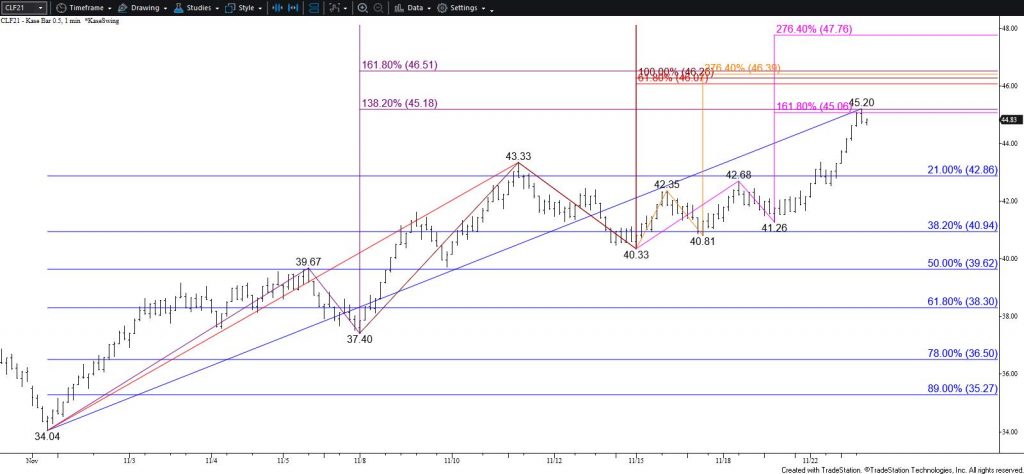

WTI Crude Oil Technical Analysis and Short-Term Forecast

WTI crude oil has rallied as called for in this week’s forecast and yesterday’s update. Today’s move up was more aggressive than anticipated but fulfilled a confluent target around $45.1. So far, this has proved to be a stalling point. Nonetheless, the decline from today’s $45.2 high forms a bullish flag on the intra-day charts. A deeper test of support might take place early tomorrow, but odds now favor a move to the next major objective and a bullish decision point at $45.4. This is the smaller than (0.618) target of the primary wave up from $26.22, a close above which will confirm a long-term bullish outlook and a resumption of the uptrend that began in late April.

Nevertheless, after such a large single day move up WTI might pull back a bit on profit taking before rising much higher. Moreover, $45.4 is a crucial objective and there is also a tremendous amount of resistance between $46.0 and $46.5. Therefore, once the $45.4 target is fulfilled a reasonably significant test of support should take place before prices rise above $46.5. For now, support at $44.0 will likely hold and $42.8 is key support for the near-term.

Brent Crude Oil Technical Analysis and Short-Term Forecast

The outlook for Brent crude oil is firmly bearish after settling above the $46.8 smaller than (0.618) target of the primary wave up from $29.35 today. This confirms a long-term bullish outlook and resumes the uptrend that began in late April. The move up is now poised to reach at $48.6, $49.1, and possibly $50.0. The $48.6 target is highly confluent but $50.0 is most important. Another reasonably significant test of support is expected once $48.6 is met and before $50.0 is overcome.

As the move up extends toward $48.6 and possibly higher today’s $46.9 midpoint is expected to hold. Key near-term support is $45.9. Settling below this would indicate a significant test of support is underway before the move up continues.

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.