Gold Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.

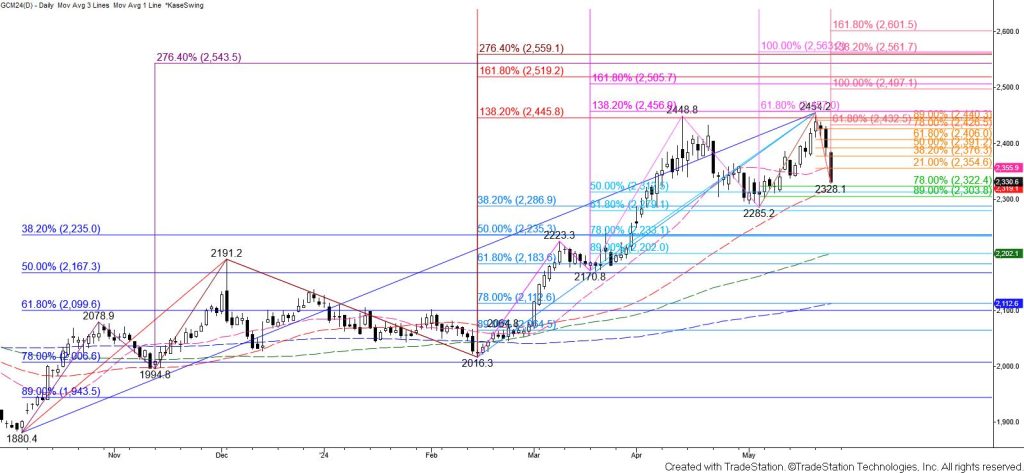

Gold’s pullback from $2454.2 extended today and settled below the 62 percent retracement of the rise from $2285.2 and the 20-day moving average. Daily bearish KasePO, KaseCD, RSI, Stochastic, and MACD divergence were also confirmed within the past few days. Currently, there is also a weekly bearish RSI divergence and a weekly bearish engulfing line. The move down is likely a correction of the uptrend, but these bearish technical factors imply that a significant test of support will likely unfold in the coming days.

Tomorrow, look for a test of $2316. This is the lowest that the first wave down from $2454.2 projects, so this is a potential stalling point. Even so, a move up will probably be a correction of the recent pullback and should hold today’s $2360 midpoint. Settling below $2316 will clear the way for a test of $2284 and possibly a major support target at $2235 in the coming days.

Should gold overcome $2360 look for a test of key near-term resistance at $2380. Settling above $2380 would warn that the corrective pullback is complete and call for a test of $2406 and possibly the $2433 smaller than (0.618) target of the wave up from $2285.2 instead.