WTI Crude Oil Technical Analysis and Short-Term Forecast

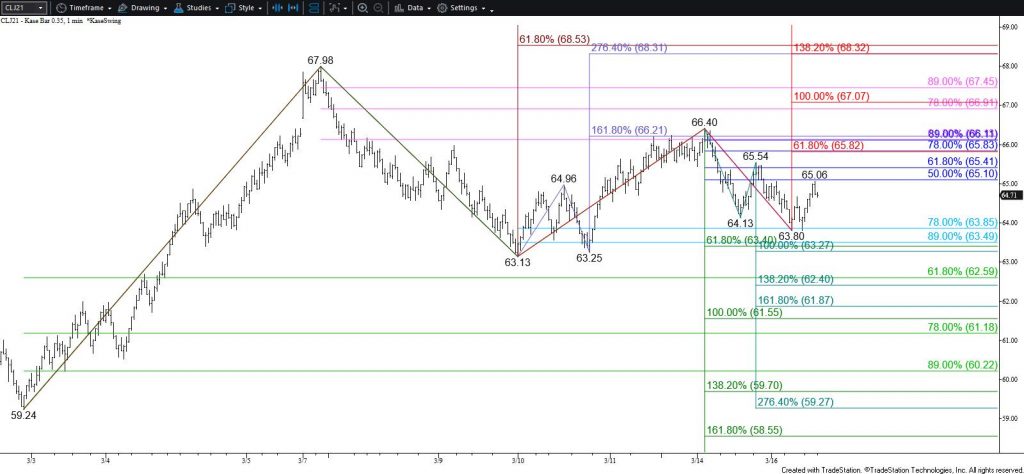

The near-term outlook for WTI crude oil tightened again today. The decline to $63.8 tested the 78 percent retracement of the rise from $63.13. More importantly, the move down took out the smaller than (0.618) target of the first subwave down from $66.4. This wave favors a test of its $63.4 equal to (1.00) target, which is also the smaller than target of the primary wave down from $67.98. Falling below $64.3 early tomorrow will call for a test of $63.4, a close below which will clear the way for $62.5 and likely $61.6. Such a move could prove to be significantly bearish for the outlook in the coming weeks because falling below $63.4 will call for a move below the 20-day moving average. Since early November this is a threshold that has been tested and held on a closing basis several times. Therefore, closing below the 20-day moving average, which should be just below $63.4 tomorrow, would likely trigger a much more significant and long overdue test of support.

With that said, the long-term outlook for WTI crude oil is undeniably bullish, and bearish setups like this have failed repeatedly during the past several weeks. Moreover, this is an extremely tight call for the next few days because the small intra-day double bottom that formed at $63.8 was confirmed by the close above the $64.67 intra-day swing high. The exact target for the double bottom is the $65.54 swing high. Overcoming $65.54 would invalidate the first subwave down from $66.4 that projects to $63.4 and clear the way for a test of $65.8 instead. This is the smaller than target of the wave up from $63.13 and connects to $67.0 and higher.

In summary, the next substantial move for WTI crude oil will likely be determined by either a close below $63.4 or above $65.8. As of this afternoon, odds lean slightly in favor of at least a test of $63.4. A move below $64.3 early tomorrow will increase those odds. However, should WTI overcome $65.54 first, odds will shift in favor of testing $65.8 instead.

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.