Gold Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.

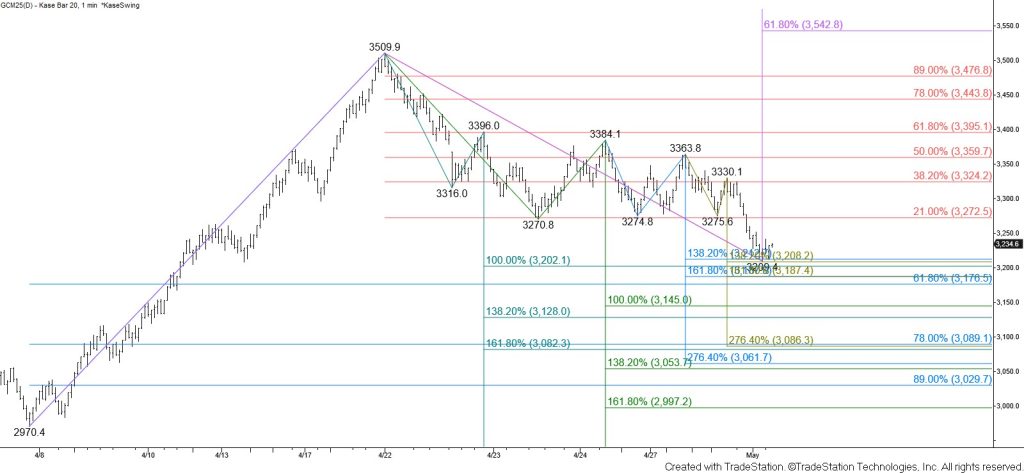

June gold took out $3275 support and broke lower out of a range that prices had been trading in for the past six days. There is a cluster of wave projections around $3205 that could provide near-term support. However, the first and primary waves down from $3509.9 call for a test of $3137. Settling below $3183 will take out the 62 percent retracement of the rise from $2970.4 and clear the way for the $3137 target to be fulfilled.

The daily Kase Trend indicator flipped to bearish today and the 10-day DMI also triggered a bearish crossover. Therefore, any move up will likely be a correction as prices fall toward $3137 in the coming days. There are also weekly bearish KaseCD, RSI, and Stochastic divergences that will be confirmed this week. Last week’s shooting star might also be confirmed by a close below $3246 tomorrow. These patterns and signals suggest that the move down from $3509.9 could prove to be a significant test of support.

Nevertheless, for the near term, should prices rise ahead of the weekend, look for initial resistance at $3273 and key resistance at $3327. Settling above $3327 would call for $3364 and possibly $3395. Closing above $3395 would imply that the pullback from $3509.9 is complete.