WTI Crude Oil Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

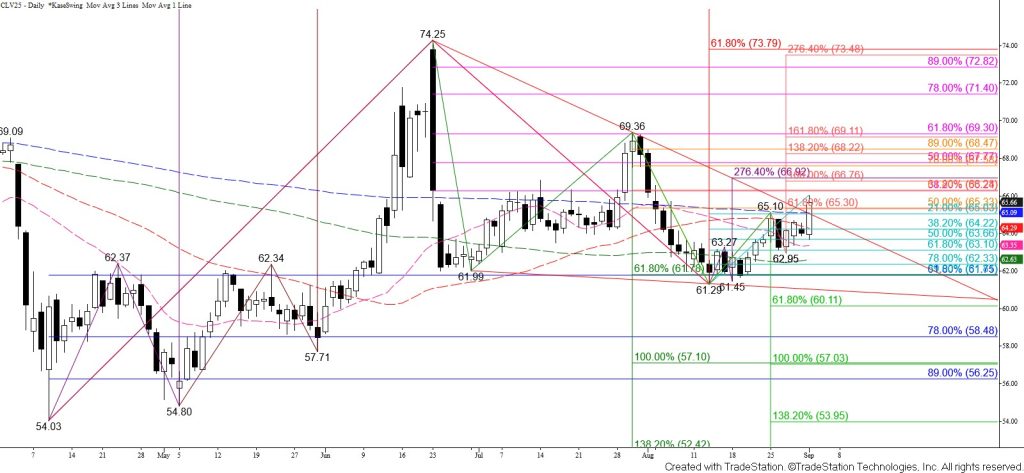

WTI crude oil rallied and broke higher out of a bullish pennant today. Prices also settled above the $65.3 smaller than (0.618) target of the primary wave up from $61.29, the 50 percent retracement from $69.36, and the 200-day moving average. WTI crude oil is now poised to challenge the 62 percent retracement from $69.36 and the 38 percent retracement from $74.25 at $66.2. This is an important target that could prove to be a stalling point. However, odds favor an eventual rise above $66.2 to challenge the $66.8 equal to (1.00) target of the wave up from $61.29. This is also the highest that the first wave up from $61.29 projects. Settling above $66.8 will confirm a bullish outlook.

There is no substantial technical evidence that suggests the move up will stall before testing at least $66.2. Even so, as stated, $66.2 is a potential stalling point. Also, it is fairly common to see a pullback to test the breakout point of a pattern after a break higher. Should price fall within the next day or so $65.1 should hold. Falling below this will call for a test of $64.7 and possibly key near-term support at $64.0. Settling below $64.0 would signal that today’s break higher out of the pennant was a false breakout. In this case, the near-term odds would shift in favor of challenging $63.1 and lower.