WTI Crude Oil Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

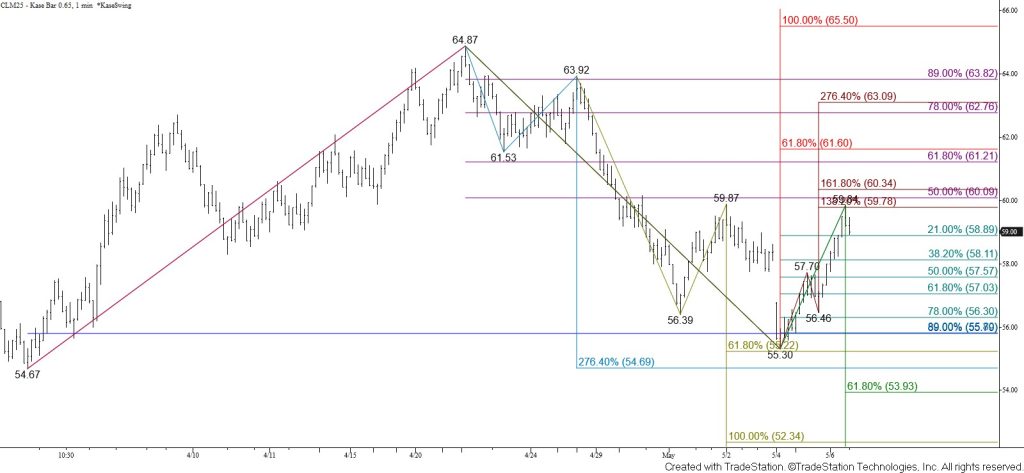

June WTI crude oil rose to test and hold the $59.8 intermediate (1.382) target of the wave up from $55.30. Prices settled above the 38 percent retracement of the decline from $64.87 and confirmed Monday’s hammer candlestick pattern. The outlook for tomorrow is bullish, and a test of the larger than (1.618) target and 50 percent retracement at $60.2 is expected. Overcoming this would call for a near-term bullish decision point at $61.4 to be challenged. This objective is split between the smaller than (0.618) target of the wave up from $54.67 and the 62 percent retracement from $64.87. Settling above $61.4 will likely be a challenge. However, this would imply that the move down from $64.87 is complete and that WTI crude oil will rise to $63.0 and then attempt to close above the 38 percent retracement of the decline from the $79.22 contract high at $64.1 again.

Nevertheless, all major prior swing highs that formed during the move down from $64.87 have held. The 10-day DMI and ADX also reflect a downtrend. Therefore, the move up from $55.30 is still a correction at this point. Prices also pulled back at the end of the day and may test the 38 percent retracement of the rise from $55.30 and today’s midpoint at $58.1 first. Falling below this would call for key near-term support at $57.1 to be challenged. Settling below $57.1 will shift the near-term outlook back to bearish, opening the way for $55.9 and lower.