WTI Crude Oil Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

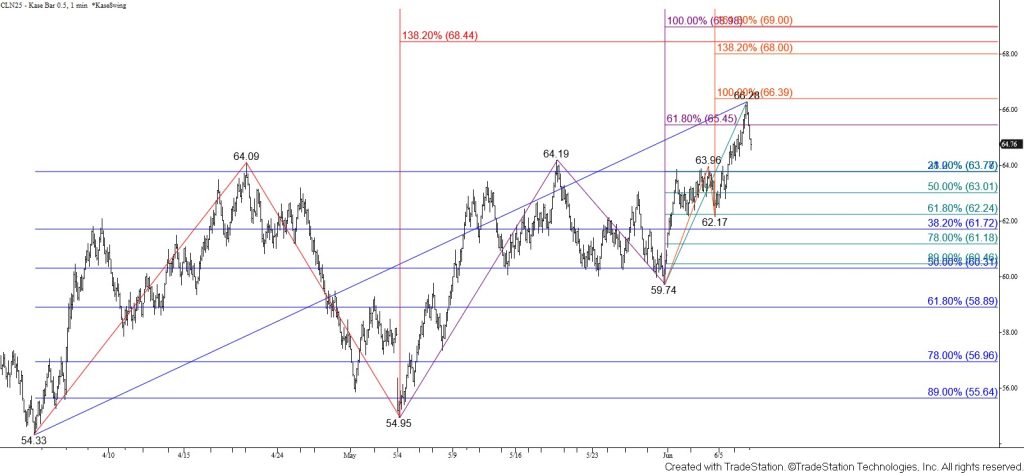

WTI crude oil rose early today and overcame the $65.5 smaller than (0.618) target of the wave up from $54.95. However, the move up stalled just below the $66.4 equal to (1.00) target of the wave up from $59.74. The subsequent pullback formed a daily dark cloud cover reversal pattern and took out the 21 percent retracement of the rise from $59.74.

The outlook for the coming weeks is bullish after the market broke higher out of the trading ranges that began in early April and May. Daily trend indicators are leaning bullish, and the primary wave up from $54.33 favors an eventual test of the $68.2 intermediate (1.382) target.

However, today’s pullback and formation of a daily dark cloud cover indicate that a test of at least $63.8 should occur before prices settle above $66.4. There are also daily bearish KaseCD and MACD divergence setups. These signals will likely be confirmed tomorrow unless a new high is made. Settling below $63.8 would call for the corrective pullback to extend to $63.0, $62.2, and possibly the 38 percent retracement of the rise from $54.33 at $61.7. A normal correction of the rise from $54.33 should hold $61.7.

That said, the move down from $66.28 lacks a clear wave, so a bounce might occur early tomorrow. Resistance at $65.5 is expected to hold. Overcoming this would suggest that the corrective pullback will be short-lived and call for another attempt to test and close above key near-term resistance at $66.4.