WTI Crude Oil Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

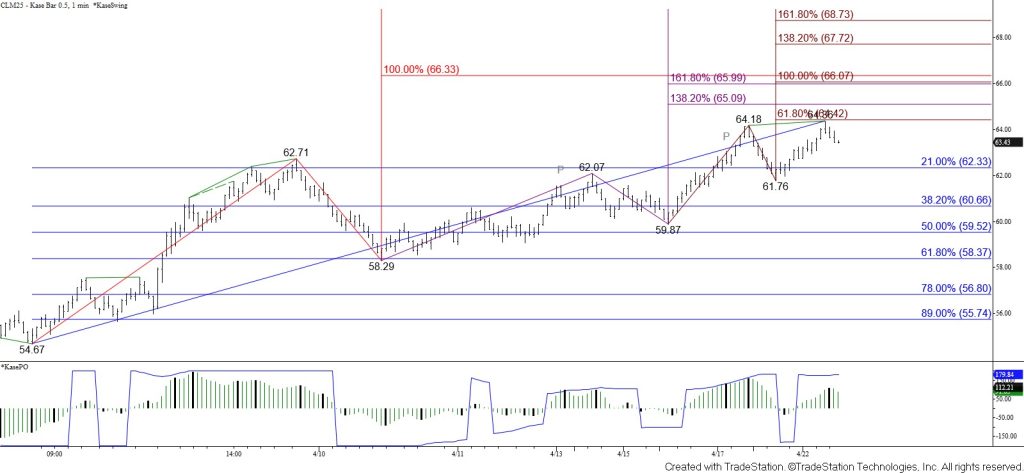

WTI crude oil rose a bit higher today as called for in Monday’s update. The move up is still poised to rise because the primary wave up from $54.67 favors a test of its $66.2 equal to (1.00) target in the coming days. Settling above the $64.4 smaller than (0.618) target of the wave up from $59.87 will call for $65.1, which then makes the connection to $66.2. A solid test of support is anticipated once the $66.2 objective is fulfilled.

That said, the June contract is struggling to settle above the 38 percent retracement of the decline from the $79.22 contract high at $64.1. A bearish KasePO divergence on the $0.50 Kase Bar chart also warns that a test of $62.5 might occur first. This level is expected to hold. Taking out $62.5 would call for a test of key near-term support and the 38 percent retracement of the rise from $54.67 at $60.7.