WTI Crude Oil Technical Analysis and Short-Term Forecast

The focus of the WTI analysis is switched to the January 2021 contract today because December will expire on Friday, November 20.

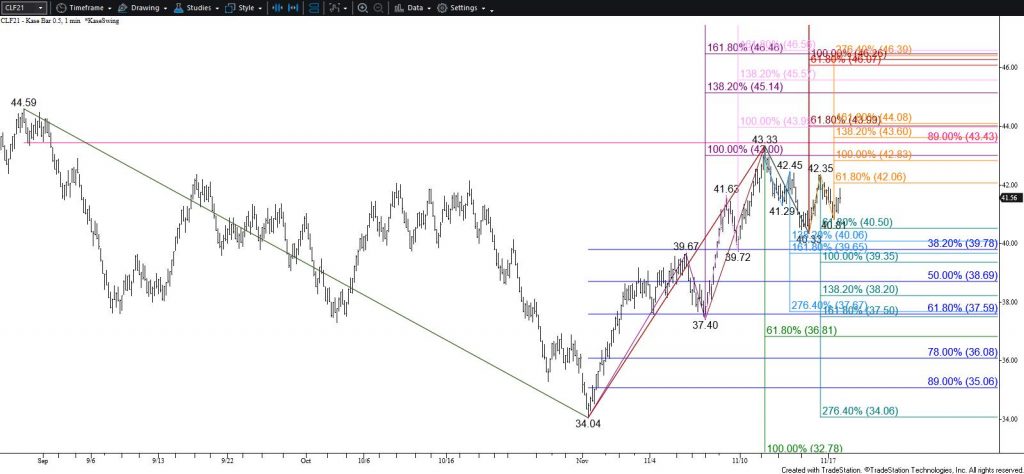

The outlook for WTI remains clouded as the market is sorting through a multitude of external factors, most importantly COVID-19 related news, that seems to shift on a day-to-day basis. January WTI is trading in a very choppy, and likely corrective, decline from last week’s $43.33 swing high. However, as stated in yesterday’s update, for the near-term, without further help from external factors there is more downside risk than upside potential. Therefore, near-term odds continue to lean in favor of a deeper test of support before the move up continues.

Falling below $40.9 will clear the way for a test of $40.4, the smaller than (0.618) target of the newly formed primary wave down from $43.33. Settling below $40.4 will clear the way for $39.8 and eventually the $39.4 equal to (1.00) target.

Nevertheless, trading is expected to continue to be erratic for the interim. Based on the wave up from $40.33, there is a reasonable chance for a test of $42.1 and possibly $42.9 first. The $42.9 level is expected to hold. Closing above this would reflect another bullish shift in near-term sentiment and call for $43.5 and then the next major objective at $44.1.

Brent Crude Oil Technical Analysis and Short-Term Forecast

January Brent is trading in a choppy, and most likely corrective, range. Even so, the newly formed primary wave down from $45.3 fulfilled its $43.02 smaller than (0.618) target when Brent fell to $43.08 today. This is bearish for the near-term and calls for test of the $41.9 equal to (1.00) target before the move up from $36.4 continues. Falling below $43.0 will call for $42.5 and eventually $41.9.

That said, the late move up from $43.08 might test $44.1 first. This is the smaller than target of the wave up from $42.63 and connects to $44.8 as the equal to target. Rising to $44.8 will dampen odds for a decline to $41.9 during the next few days. Nonetheless, $44.8 is expected to hold. Closing above this would shift near-term odds in favor of rising to $45.8 and higher.This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial