WTI Crude Oil Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

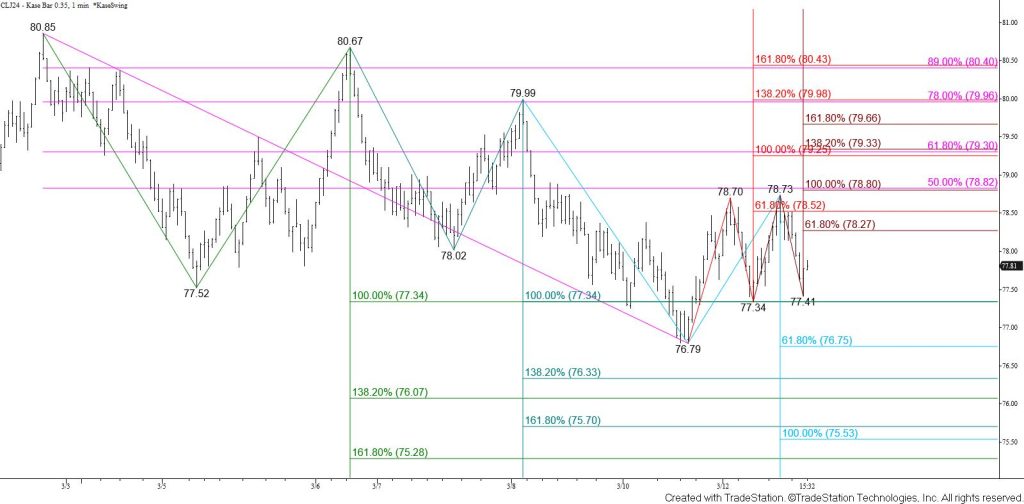

WTI crude oil tested and held the $77.3 equal to (1.00) target of the primary wave down $80.85 on a closing basis again today. The $77.3 objective is also the equal to target of the wave down from $80.67 and the 38 percent retracement of the rise from $71.49. This has become an important target because closing below $77.3 would imply that the move down from $80.85 is more than a simple correction. Near-term odds still favor such a move, which will open the way for a test of the $76.2 intermediate (1.382) and possibly the $75.4 larger than (1.618) targets of the wave down from $80.85 in the coming days.

Nevertheless, another daily long-legged doji reflects uncertainty and warns that the corrective pullback from $80.85 might be complete. Settling above $79.3, the equal to target of the wave up from $76.79 and 62 percent retracement of the decline from $80.85, would strongly suggest this is the case. Closing above $79.9, the smaller than (0.618) target of the wave up from $75.84 and intermediate target of the wave up from $76.79, would confirm this is the case and put near-term odds in favor of $80.4 and higher.