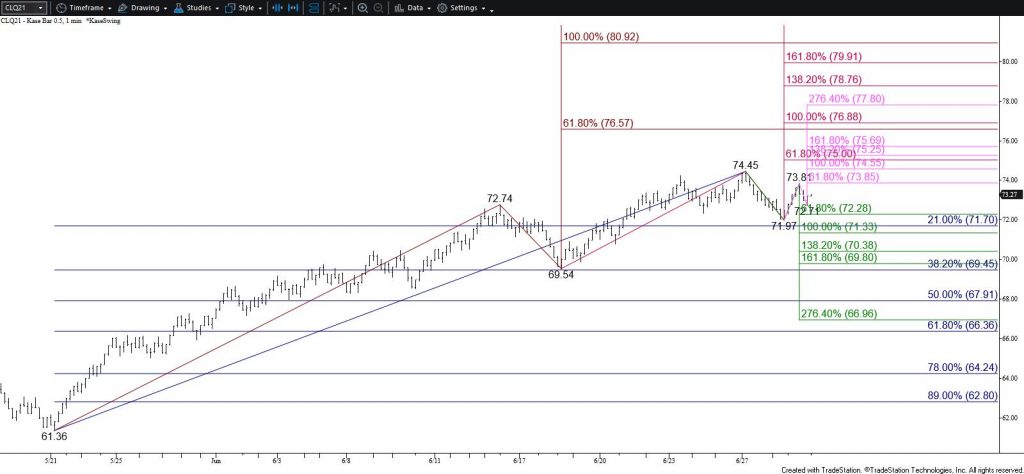

WTI Crude Oil Technical Analysis and Short-Term Forecast

WTI crude oil fell to challenge $72.0 as called for in Monday’s daily update. However, the subsequent move up from $71.97 has formed a wave that is poised to test $73.9. Rising above this objective early tomorrow will clear the way for a major objective at $75.0. This is the most confluent target on the chart and is a probable stalling point.

With that said, the near-term outlook is tight and there is still a reasonable chance for a deeper test of support before reaching $75.0. Should WTI take out $72.1 before overcoming $73.9 look for a test of $71.2. Closing below $71.2 would confirm the daily bearish candlesticks patterns that formed last week and would shift near-term odds in favor of reaching $70.4 and likely $69.6 during the next few days.

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.