Brent Crude Oil Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

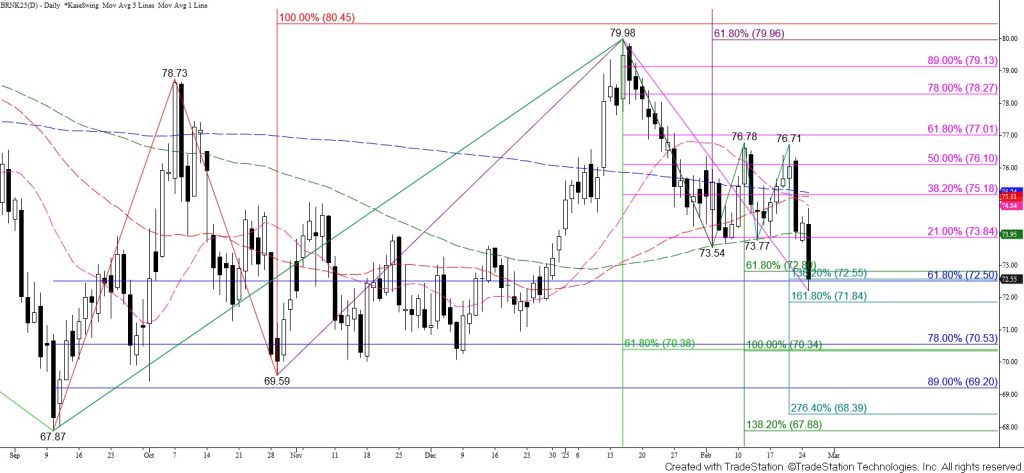

May Brent crude oil finally broke to the downside again and has definitively taken out support around $73.6. Brent also settled below the smaller than (0.618) target of the wave down from $79.98 and the intermediate (1.382) target of the wave down from $76.78. This was bearish for the outlook in the coming days and perhaps weeks because the wave down from $79.98 now favors a test of its $70.4 equal to (1.00) target. This is also the 78 percent retracement from $67.87, and more importantly, the smaller than target of the wave down from $83.4. Therefore, $70.4 is a longer-term bearish decision point because a sustained close below this objective will open the way for an eventual test of the $64.5 equal to target of the wave down from $83.4.

For tomorrow, look for a test of the $71.8 larger than (1.618) target of the wave down from $76.78. Settling below this will call for minor targets at $71.5 and $71.0 that make a connection to $70.4.

That said, today’s decline tested and held the 62 percent retracement of the rise from $67.87 at $72.5 on a closing basis. This is a potential stalling point. However, any move up will likely be a correction. Today’s $73.4 midpoint is expected to hold. Key resistance for the near term is today’s $74.3 open.