Brent Crude Oil Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

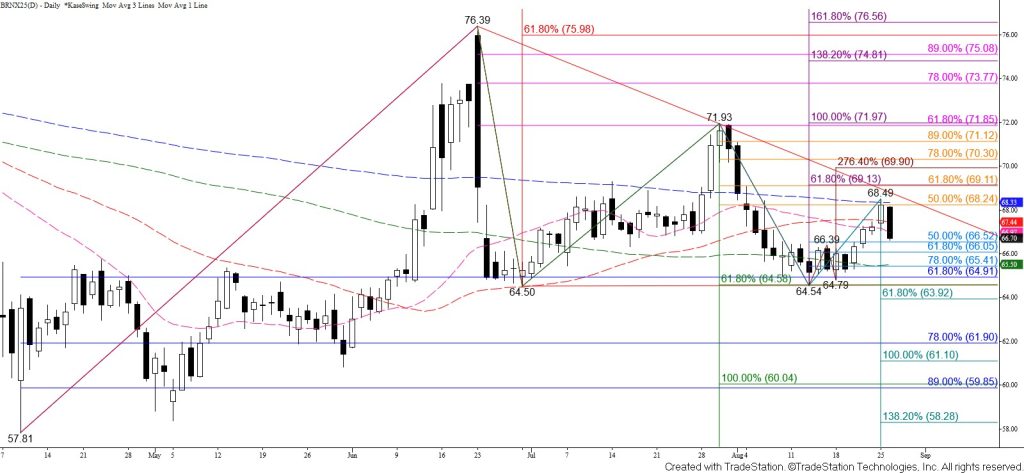

November Brent crude oil held the 50 percent retracement of the decline from $71.93 and the 200-day moving average on a closing basis on Monday. Today’s decline retraced nearly 50 percent of the rise from $64.54 and has put prices back below the 20- and 50-day moving averages. This suggests that the corrective move up from $64.54 is complete.

Tomorrow, look for a test of the 62 percent retracement at $66.1. Settling below this will call for another attempt to take out the 62 percent retracement of the rise from 57.81 and the 100-day moving average at $64.9. Closing below $64.9 will clear the way for another test of the $64.6 smaller than (0.618) target of the wave down from $76.39. This is a bearish decision point because settling below $64.6 for a few days would open the way for an eventual test of this wave’s $60.0 equal to (1.00) target and break the bottom trend line of a large flat descending triangle around $64.5.

That said, the move up from $64.54 stalled short of the upper trend line of the flat descending triangle pattern. Should prices rally again and close above $68.6, look for a break higher out of the pattern to challenge the $69.1 smaller than target of the wave up from $64.5. This is also the 62 percent retracement of the decline from $71.93. The wave up from $64.5 connects to $72.0 as the equal to target.