Gold Technical Analysis and Near-Term Outlook

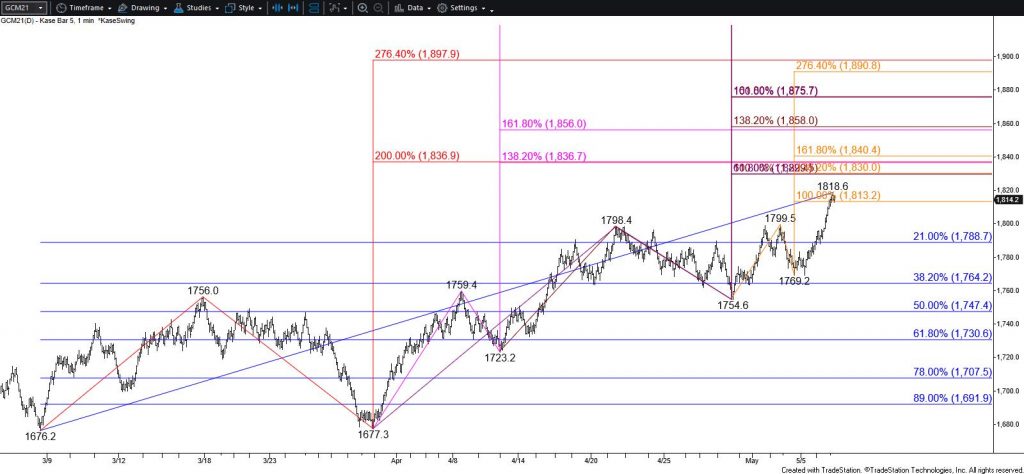

Gold rallied again and settled above the highly confluent $1806 larger than (1.618) target of the primary wave up from $1676.2. The outlook is firmly bullish headed into tomorrow. The move up is now poised to challenge at least $1827 and likely $1837 during the next few days. The $1837 objective is another highly confluent wave projection and the target of the $1676 double bottom. Settling above $1837 might initially prove to be a challenge but would clear the way for $1857 and higher.

A few daily momentum oscillators are set up for bearish divergence but both momentum and price will have to peak to confirm these signals. Otherwise, there are no major bearish patterns or confirmed signals that call for a reversal. Even so, should gold pullback tomorrow look for today’s $1801 midpoint to hold. Key near-term support is $1787, a close below which would shift near-term odds in favor of a deeper test of support before the move up continues.

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.