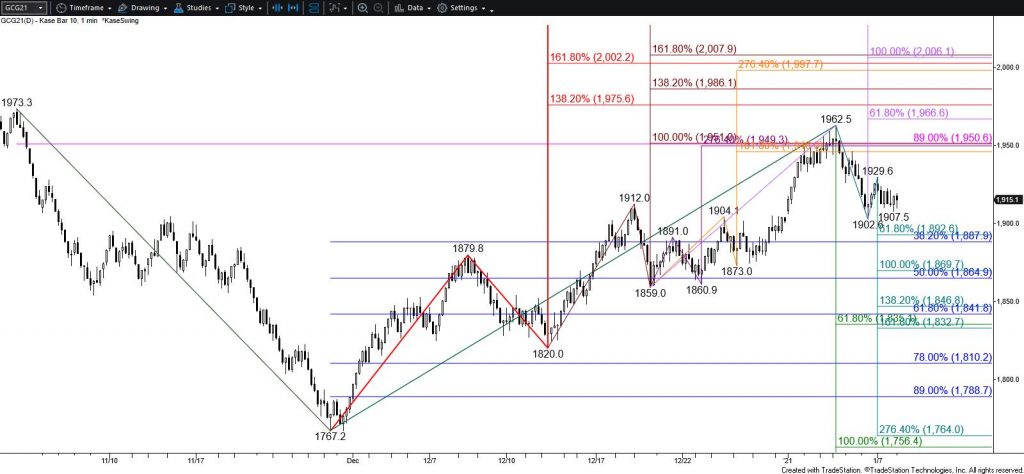

Gold Technical Analysis and Near-Term Outlook

Gold has begun to take on a more positive long-term outlook during the past few weeks. The primary wave up from $1767.2 is still poised to eventually challenge a bullish decision point at $1974. However, the move up stalled at $1962.5, and the subsequent pullback to $1902.6 completed a daily bearish evening star and KaseCD momentum divergence signal. Therefore, the near-term outlook is bearish and a close below the 100-day moving average around $1906 will clear the way for $1891 and possibly $1867 during the next few days. Settling below $1867 is currently doubtful but would call for a bearish decision point at $1838 to be challenged. Closing below this would strongly suggest that the move up has failed and that the larger-scale decline from $2099.2 will continue.

With that said, trading was quite choppy today and held the 100-day moving average for the second straight day. Should gold overcome $1935, yesterday’s midpoint and the 62 percent retracement of the decline from $1962.5, look for a test of key near-term resistance at $1955. Settling above this would reaffirm a positive near-term outlook and call for a test of the $1974 bullish decision point.

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.