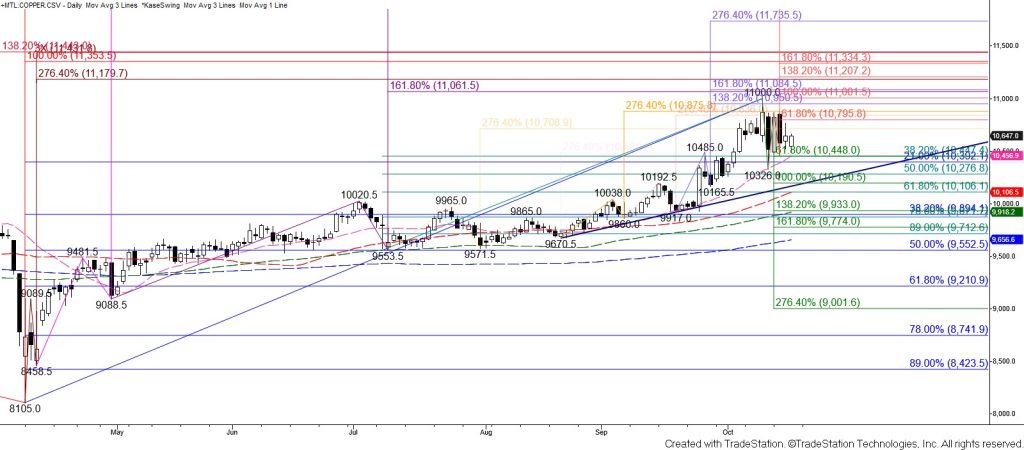

LME Copper Technical Analysis and Near-Term Outlook

The near-term call for copper remains extremely tight and has become a near 50/50 call. Tomorrow’s outlook leans bearish, but it is beginning to look like the corrective move down from $11000 will fail to extend. The key levels to watch are $10448 and $10794 ahead of the weekend.

The wave down from $10864.5 fulfilled its $10518 smaller than (0.618) target today, so this wave calls for a continued decline that would challenge the key $10448 smaller than (0.618) target of the wave down from $11000. Settling below $10448 will clear the way for a test of this wave’s $10201 equal to (1.00) target before the uptrend extends to a new high.

That said, copper must take out $10518 again, and the wave up from $10463 is approaching its $10677 smaller than target. Overcoming this would call for a test of this wave’s $10794 equal to target. This is key near-term resistance because $10794 is also the smaller than target of the wave up from $10326. Settling above $10794 will imply that the corrective pullback from $11000 is complete, opening the way for $10917 and higher.