NY Harbor ULSD Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

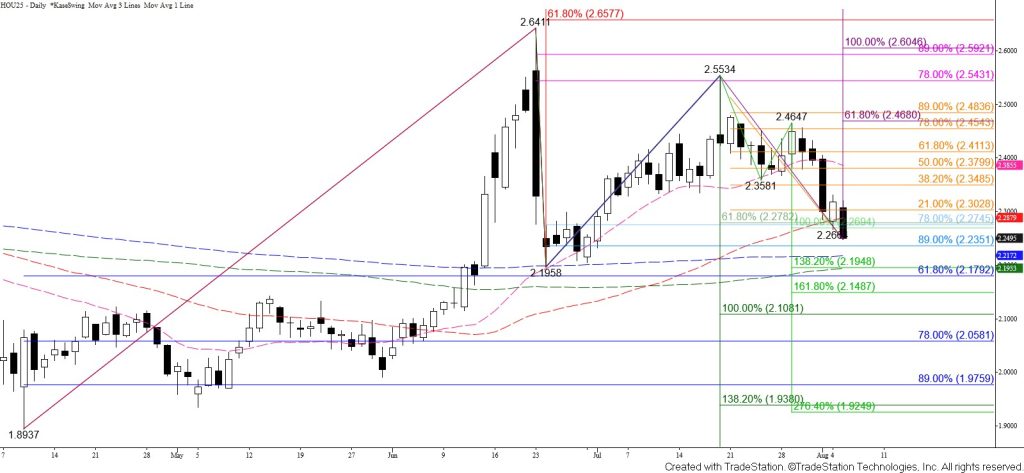

Diesel settled below the smaller than (0.618) target of the wave down from $2.6411, the equal to (1.00) target of the wave down from $2.5534, the 78 percent retracement of the rise from $2.1958, and the 50-day moving average today. This was bearish for the outlook and strongly implies that diesel has adopted a bearish outlook for the coming weeks because the wave down from $2.6411 now favors an eventual test of its $2.108 equal to target.

Tomorrow, look for a test of the 89 percent retracement at $2.231. This is also a confluent projection for the intraday waves down from $2.4647. Closing below $2.231 will call for the $2.195 intermediate (1.382) target of the wave down from $2.5534 and then a test of the 62 percent retracement of the rise from $1.8937 at $2.179. Settling below $2.179 will confirm a bearish outlook for the coming weeks and clear the way for $2.149 and $2.108.

Daily trend indicators are now bearish, and there are no bullish patterns or confirmed signals that call for the move down to stall. The daily Stochastic is oversold but can remain that way for an extended period. The daily KasePO, KaseCD, and RSI are not oversold yet and must take out the $2.1958 swing low to possibly set up bullish divergences (provided momentum does not fall to new lows too). Nevertheless, should prices rally and overcome $2.305, look for a test of key near-term resistance at $2.350.