WTI Crude Oil Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

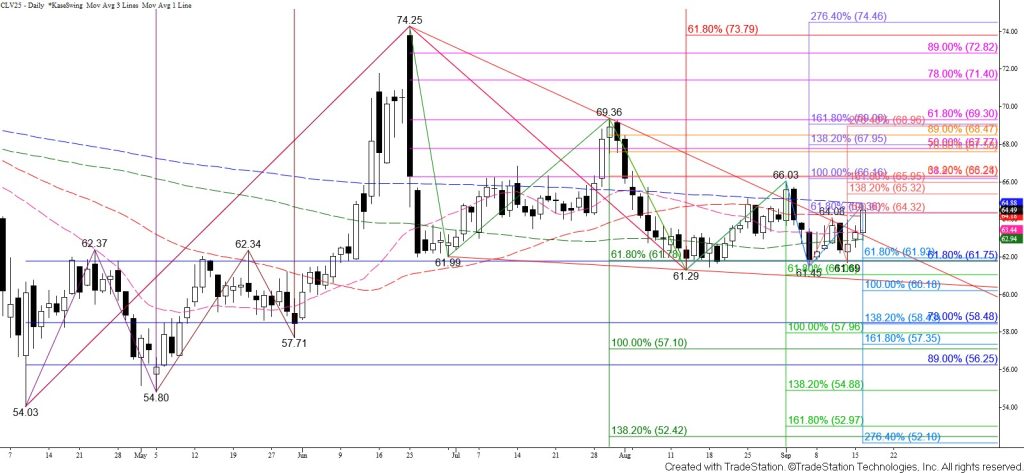

WTI crude oil broke higher out of a bullish pennant again. Prices also settled above the $64.3 smaller than (0.618) target of the wave up from $61.29 and the equal to (1.00) target of the wave up from $61.45. The move up is now poised to reach the $65.3 intermediate (1.382) target of the wave up from $61.45 and then the next major objective at $66.2. The $66.2 objective is key because it is the equal to target of the wave up from $61.29, the 38 percent retracement of the decline from $74.25, and the 62 percent retracement from $69.36. Settling above $66.2 will confirm a break higher and a bullish outlook for WTI crude oil.

Today’s move up stalled just below the 200-day moving average. However, there are no bearish patterns or signals that call for the move up to stall. Even so, with a false break higher out of the pennant taking place just a couple of weeks ago, WTI crude oil must confirm this breakout and a firm bullish outlook by settling above $66.2. Should prices fall and close below $63.4, look for WTI to fall back below the upper trend line of the pennant, signaling another false breakout. In this case, the near-term odds would shift in favor of testing resilient support at $61.8 again.