WTI Crude Oil Technical Analysis and Short-Term Forecast

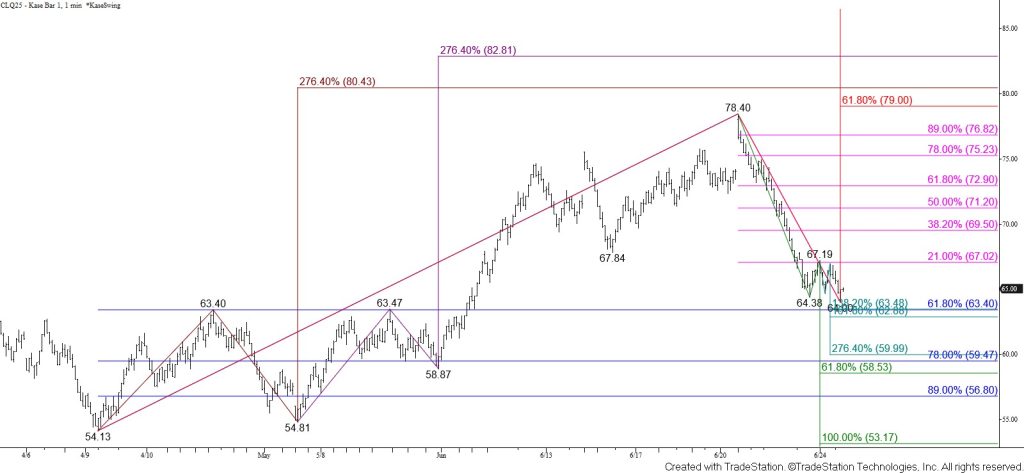

WTI crude oil continued to fall as called for. Monday’s bearish engulfing line and the confirmation of daily RSI and Stochastic overbought signals suggest that a reversal is underway. Prices have also taken out an important swing low at $67.84 and settled below the 50 percent retracement of the rise from $54.13 and the 20-, 100-, and 200-day moving averages. Tomorrow, look for a test of the 62 percent retracement at $63.4. This is also the intermediate (1.382) target of the wave down from $67.19. A sustained close below $63.4 will confirm a bearish reversal and open the way for a continued decline in the coming days.

The decline from $78.40 is due for a correction. Prices bounced from $64.38, but the retracement was minimal relative to the size of the move down. The challenge is that there are no bullish patterns, signals, or setups that call for a test of resistance. The $63.4 target is an ideal stalling point, but again, there are no bullish factors that call for $63.4 to hold at this point.

Should prices rally before taking out $63.4 and close above today’s $67.7 open, look for a test of the 38 percent retracement of the decline from $78.40 at $69.5. A normal correction is expected to hold $69.5. Closing above this would reflect rising bullish sentiment again, opening the way for a more significant test of resistance.