WTI Crude Oil Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

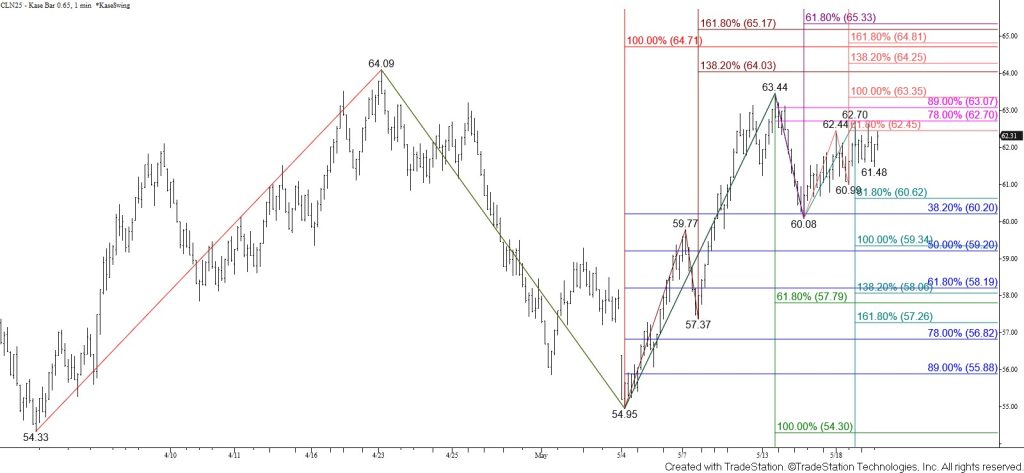

WTI crude oil continues to trade near the upper end of a wide range that began in early April. Prices rose to challenge the 78 percent retracement of the decline from $63.44 at $62.7 early this week and fulfilled the smaller than (0.618) target of the wave up from $60.08. This wave calls for a test of its $63.5 equal to (1.00) target, which is in line with the 38 percent retracement of the decline from the $78.48 contract high. The $63.5 objective has been tested a few times and has been held on a closing basis. Even so, another test of $63.5 will not likely hold because the wave up from $54.33 favors a test of its $64.7 equal to (1.00) target. Therefore, the near-term outlook for WTI crude oil is bullish.

Nevertheless, trading early this week has reflected uncertainty, warning that another test of support might occur before breaking higher out of the range. Should prices settle below the $60.6 smaller than (0.618) target of the wave down from $63.44, look for a test of $60.2 and then the $59.3 equal to (1.00) target of this wave. The $59.3 level is expected to hold. Settling below this would call for a bearish decision point within the range around $58.0 to be tested.